Your credit rating plays a primary character on the home loan approval process; it decides what kinds of fund you may be entitled to, how much cash you might be likely to establish at the closure, the interest levels plus home loan insurance. This is exactly why, ahead of looking for where you can find the desires, it is vital to make sure your credit rating is within a great shape.

At some point when you look at the mortgage approval procedure, the financial institution usually assign an enthusiastic underwriter to review your financial history, your debt-to-earnings proportion and your credit rating, one of other factors. The financial institution uses this short article to decide how probably you are to repay your loan punctually. A higher credit history shows that you have several outlines off borrowing from the bank open and now have consistently produced monthly premiums towards all of all of them, and that reveals personal obligations and you possess the expected funding to repay the loan.

800+ Credit score Financial: How good Borrowing Has an effect on Your own Rates

In addition to leading you to a attractive candidate to possess a good mortgage, a high credit score is sold with professionals including down financial pricing, and you may, ultimately, all the way down monthly mortgage payments.

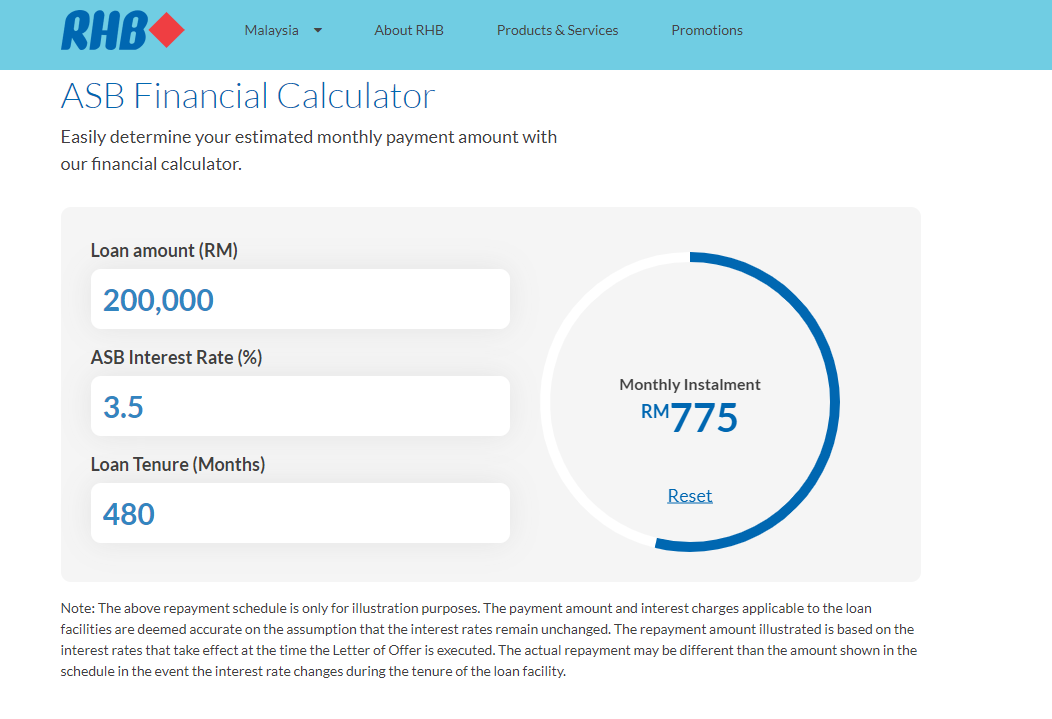

Thus, how much does appear as in routine? We already know just by using a great credit rating, there is the ideal opportunity to secure a focus speed. And you will given the multiple interest rate slices adopted from the government set aside responding to the COVID-19, their high credit score can provide an unbelievable rate. Become safer, let me reveal a report about credit history, Apr fee, asked monthly payment and you may total curious paid back on a thirty-12 months fixed financing off $two hundred,000, centered on conventional 2019 number.

What is Thought a Good’ Credit history?

In accordance with the Fair Isaac Agency (FICO) model – the high quality utilized by very loan providers – fico scores start from 3 hundred up to 850. In terms of what exactly is good credit compared to. a less than perfect credit rating, an average selections are:

- Exceptional 800 or even more

- Very good 740 so you’re able to 799

- A beneficial 670 in order to 739

- Fair 580 so you’re able to 669

- Worst 579 otherwise lower

Normally, with regards to making an application for a mortgage, the better your credit score, the better. Very fund need a credit rating off 580 or higher so you’re able to qualify, even in the event specific loan types be much more easy into straight down fico scores (much more about one to afterwards). A credit score ranging from 620 and you may 739 leaves you within the reasonable area, if you are a credit history anywhere between 740 and you can 850 is regarded as better level. Possible home buyers with a credit history off 740 and you can significantly more than can expect:

- Down Apr percent

- Straight down month-to-month home loan repayments

- Less interest paid back over time

So it better tier is where the fresh new signal the greater, the better goes out brand new screen. Out-of a great lender’s perspective, there can be effortlessly no difference in a home visitors having a cards score out-of 740 and another that have a get of, state, 800 – both are eligible for an equivalent masters, together with down mortgage rates. No matter what method of or size of mortgage you will find, there’s absolutely no variance anywhere between an excellent 740 credit score mortgage rate, an enthusiastic 800 credit score financial rates and you may a keen 850 credit history mortgage speed.

The only exemption to that is actually individual home loan insurance rates (PMI). Lenders normally require PMI at home buyers who’ve repaid less than 20% down. Exactly how much you pay during the PMI utilizes a great amount of things, in addition to exactly how much you put down on closure, the regards to your home loan plus financial status; which past product refers particularly into credit score. In the wide world of PMI, a perfect credit rating is actually 760 and you can, for many who fall into these kinds, you are guaranteed a reduced you can easily PMI costs for the particular situations. Which difference between PMI rate was effectively truly the only difference between an excellent 740 credit rating home loan and you can an enthusiastic 800 credit rating home loan.