Regardless if crisis funds is meant for problems, they can be accustomed pay money for several one thing

- Good $25,000 limitation exact same-go out amount borrowed is available instantly.

- There’s absolutely no prepayment penalty.

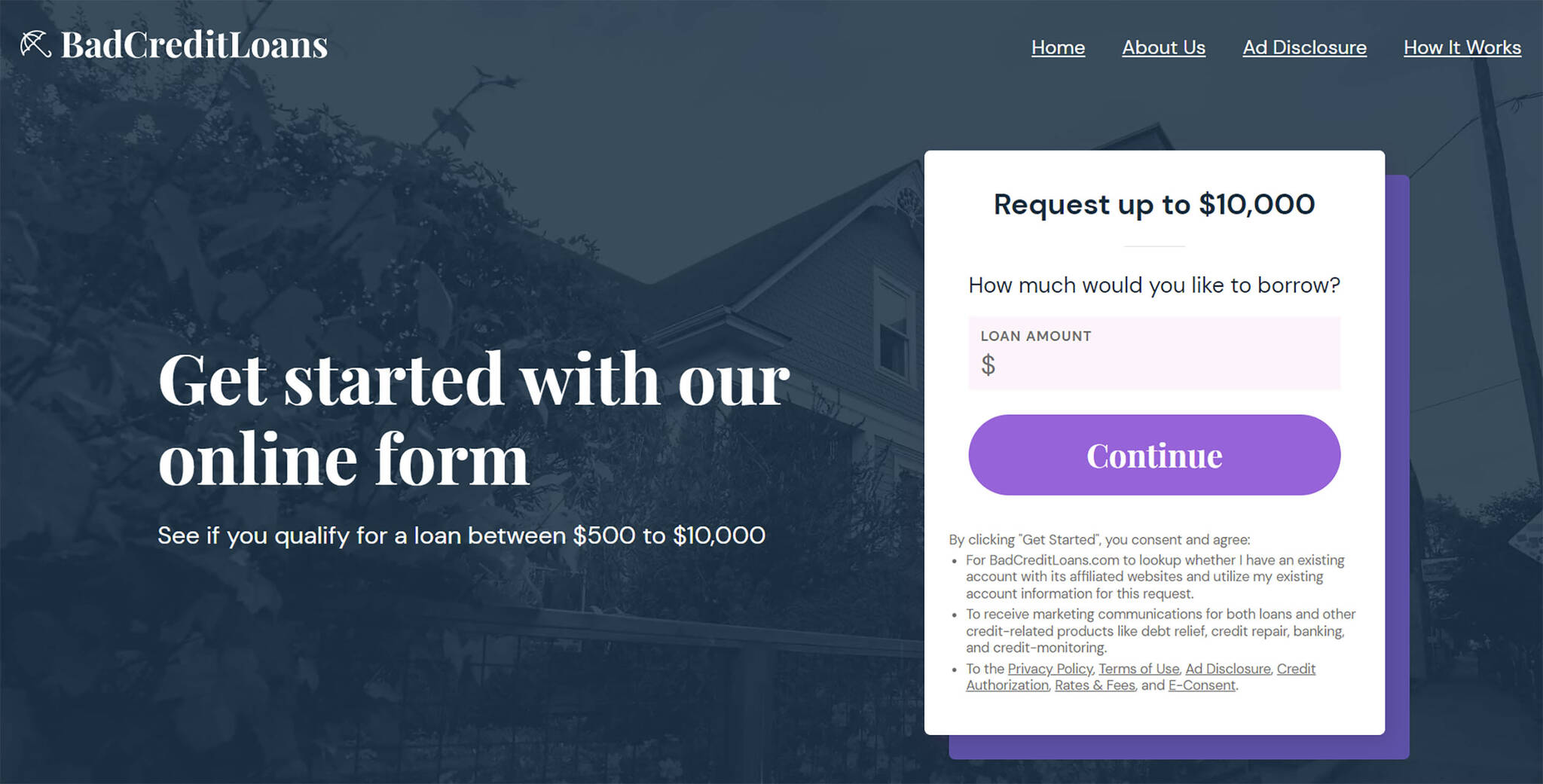

- You could fill out an application on the internet.

Regardless if crisis financing try intended for issues, they may be regularly buy many anything

- Consumers spend an origination commission of just one% in order to 6% of your loan amount.

- There are only 36 and you will sixty-few days financing terminology offered.

- Minimal credit score required for loan recognition try 620.

After the 2008 financial crisis, OppLoans began making loans available to those who had fallen on hard times. OppLoans is unique in https://www.clickcashadvance.com/personal-loans-ut/salt-lake-city that it offers a tailored approach to its lending services. You will find it simple to obtain authorization for their loans even if you have bad credit history.

OppLoans provides fees fund for up to $4,000. The annual percentage rate (APR) commonly sits around 160%, while loan periods span anywhere from nine to 18 months. The lending company is a great choice for people who need money to pay for unexpected costs.

And merging costs, such loans can be utilized for many different aim, including scientific expense, car solutions, swinging expenditures, and you can home improvement strategies. Yet not, you should just remember that , you must eat the borrowed funds amount such that it can lessen debt fret.

Regardless if disaster finance was intended for issues, they can be regularly purchase many some thing

- Loans will come contained in this 2-3 working days.

- Web site safeguards is actually secured.

- No checks to your borrowing.

There are a number off small-name finance if you have less than perfect credit that will enable you to get off a beneficial jam. If you have bad credit, it is important to look around and find an informed loan for your needs. The loan qualities i in the list above are legitimate, legitimate, and one of the better in the market. And when need let, you’re taking a look at these services and watch or no of these can help you

The fresh approval techniques to possess disaster money is commonly finished quickly, and borrowers will get assume its dumps within a couple of days. Although not, there are particular loan providers that may also loans finance into exact same day that you apply in their mind on time.

New therefore-named zero credit score assessment money that have protected recognition are apt to have higher dangers, making it ideal to avoid them. If the credit rating is actually bad and would like to pick a beneficial mortgage, find the lenders one consider affairs except that the fresh borrower’s credit rating, such as its income, jobs, and you will financial stability.

If you’re unable to receive a crisis mortgage, most other solutions is generally available to choose from. Including using a charge card, providing a pay check option financing owing to a card partnership, otherwise credit away from nearest and dearest or family relations. But keep in mind that this type of choice enjoys their own disadvantages and you will threats.

Which have CocoLoans, you may apply to many online creditors by using simply one simple software. This type of creditors are able to offer an emergency loan all the way to $thirty five,one hundred thousand and import the bucks to your family savings contained in this good solitary working day.

Consumers throughout the usa (excluding West Virginia and you may Iowa) qualify to try to get signature loans all the way to $fifty,100000. In the event you can buy a loan from their store, though, relies on your revenue, credit rating, and other recommendations you give in your application for the loan.

A crisis financing you may safeguards any prices one to emerged out of the blue, eg substitution inventory otherwise gizmos, fixing a roof otherwise ac, otherwise choosing temporary let.