Version of Mortgage Pricing

Homebuyers trying to find an easily affordable financial is also examine various interest rates to discover a knowledgeable complement their situation. The 2 particular home loan cost try fixed-price mortgage loans and you can adjustable-price mortgage loans. (ARMs)

Variable Rate Financial vs. Repaired

Fixed-Rate Mortgage: A home loan with an interest price you to definitely stays a comparable regarding lifetime of the borrowed funds. This is why your own monthly fees amount will stay a similar. Consumers can be imagine the entire customer settlement costs and you can bundle in the future of your time.

Adjustable-Rate Financial: Home financing has an interest rates one transform across the life of the loan. The speed can differ from month to month centered on markets indexes. How often the interest rate changes depends on your loan arrangement.

The latest monthly payments is actually in person proportional towards type of attention speed you choose. You might determine the last charges for the house you desire to acquire considering debt standing and you will certain mortgage terminology.

15-, 20- and you can 30-Seasons Mortgages

Property consumer can pick that time to repay the mortgage. It will be either an effective fifteen-year repaired price mortgage or a 30-12 months varying rate mortgage.

A preliminary-identity mortgage, such an excellent fifteen-season otherwise 20-seasons loan, mode high monthly premiums. not, you will spend considerably lower than the eye on the a 30-year financing.

You might decide which form of mortgage months is the best situated in your finances, eg current money and you can possessions.

What Impacts Home loan Costs?

Whenever credit money for purchasing a home, the mortgage interest is a precursor so you can how much the property costs. The factors that affect mortgage rates supply a role to help you gamble right here.

- Inflation

- Government Reserve Financial Rules

- Financial Growth rate

- Housing industry Standards

Mortgage Prices and Real estate market

In case the mortgage costs is higher, you will have restricted home buyers choosing to score a home loan, and you can house have a tendency to save money weeks to your industry, so it is a consumer’s markets.

If the home loan prices is low, upcoming there’ll be online loans Alamosa East, CO far more people putting in a bid getting properties. Household conversion process would-be reduced, and you may land in the desirable places will likely earn the new putting in a bid conflict amidst several offers, so it’s a trending seller’s markets.

Type of Mortgages

step 1. Government-Backed Mortgage loans: The newest U.S encourages owning a home all over The usa that have FHA, Virtual assistant and you will USDA finance. Government entities isnt a lender right here, but i have organizations such as the FHA (Government Property Organization), USDA (You Agencies from Agriculture), and also the Virtual assistant (Pros Administration Agencies). to truly get your financial canned thru available lenders.

3. Jumbo Fund: Fund that fall method above the standard borrowing from the bank limits. Most suitable for consumers looking to purchase a costly assets

cuatro. Fixed-Speed Mortgages: A mortgage in which the interest is fixed and you may cannot change over new lifetime of the borrowed funds.The brand new monthly payment does not transform till the financing is finalized.

5. Adjustable-Rate Mortgage loans: A mortgage loan the spot where the interest rate alter according to the volume decideded upon to your financial. The newest payment per month may differ along the lifetime of the borrowed funds.

- Balloon Mortgage loans

- Piggyback Loans

- Difficult Money Finance

- Framework Finance

The way to get a mortgage?

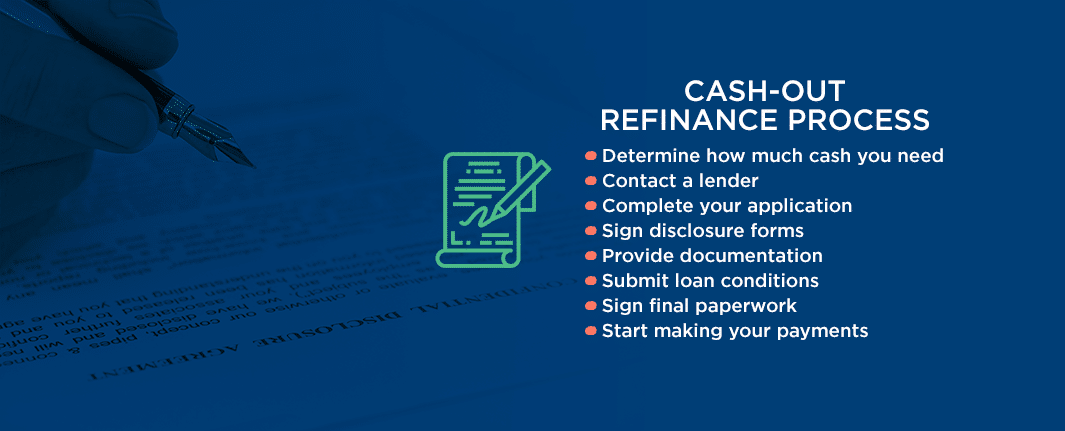

Methodically bundle the home get. Regarding strengthening your credit rating to hunting for our home your need, everything will take time. One step-by-action process to score a mortgage generally ends up it:

- Increase Credit rating: To stop purchasing high desire, you ought to strengthen your credit history. And then make fast money for the financial obligations will help improve your rating over the years. Despite a poor credit get, you can get home financing, however the interest might possibly be significantly highest.