When you begin thinking of buying a house, you are able to tune in to about mortgage pricing and just how far they sucks that they are rising, exactly how high it is if they’re going down, or even as to the reasons reduced mortgage cost commonly usually a good question.

Exactly how do you can so it fee? And exactly how does it really apply at how much you pay? On the purposes of this short article, I’ll examine how only a 1% difference between their financial speed is also absolutely connect with exactly how much your spend.

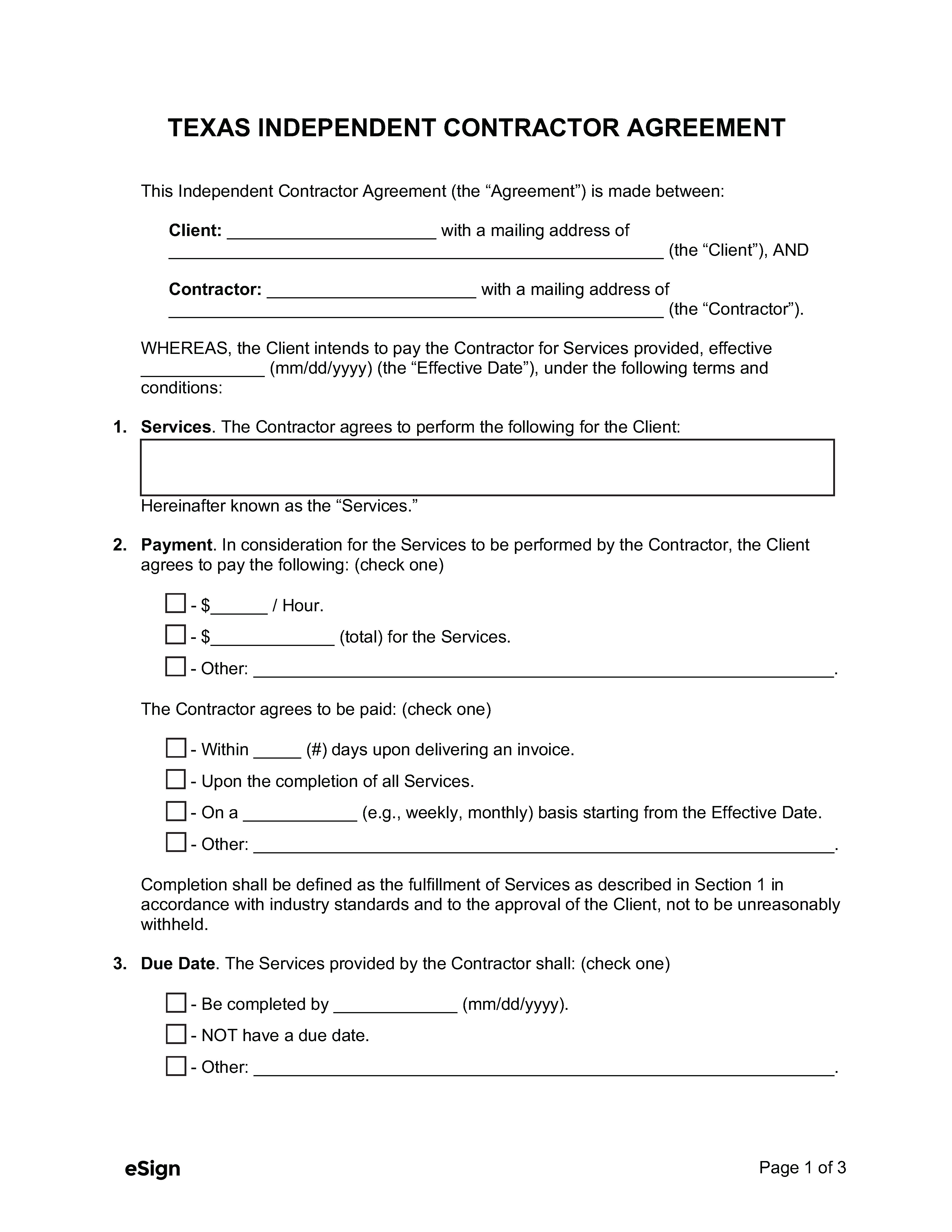

As you will observe regarding the desk less than, a-1% difference in a $200,000 home with a great $160,000 financial increases the payment per month of the nearly $100. As the difference between payment per month may not seem you to significant, the fresh 1% higher rate mode you’ll shell out approximately $30,000 a lot more from inside the desire over the 31-seasons title. Ouch!

Just how mortgage interest rates performs

Home financing is a kind of financing accustomed purchase a good family or other a home. The interest rate on a home loan ‘s the part of brand new total loan amount that you will have to invest at exactly the same time towards prominent, or completely new, amount borrowed.

The rate to your a mortgage is oftentimes indicated since the an annual percentage rate, otherwise Annual percentage rate. Because of this you will need to repay the loan as well as desire charges over the course of the life of the mortgage. The rate for the home financing are repaired or varying, based on your lender’s fine print.

When you yourself have a predetermined-rates mortgage, in that case your rate of interest will not change-over living out-of the loan. But when you has a changeable-price home loan, this may be can also be vary according to research by the Perfect speed, eg.

How a-1% difference in mortgage speed influences what you pay

Contained in this example, what if you want to to carry out a mortgage to have $two hundred,000. If you get a thirty-12 months home loan and you also create a beneficial 20% down payment away from $40,000, you should have an excellent $160,000 home loan.

For people who merely set out 10%, you have a great $180,000 mortgage. Another dining table demonstrates how far you’ll shell out – each other 30 days as well as over living of your own loan – from inside the for each condition.

*Percentage wide variety revealed do not are personal mortgage insurance rates (PMI), that can be required into loans that have off payments off quicker than just 20%. The genuine payment per month is large.

It formula including doesn’t come with assets taxes, which could enhance the cost significantly if you reside during the a high-tax town.

Contained in this analogy, a 1% home loan speed improvement contributes to a payment per month which is next to $100 higher. Although real difference is where so much more you are able to spend inside the focus more than 3 decades…over $33,000! And simply thought, if you stayed in the latest eighties when the highest financial speed is 18%, would certainly be spending plenty thirty days only into the focus!

What is actually loans Durango currently happening so you’re able to mortgage cost?

COVID-19 pushed home loan interest levels down to record downs, dipping in order to a chin-losing 2.67% inside the . Regrettably, 30-season repaired home loan pricing have since the ballooned to help you on average 8.48% since .

But don’t be too bummed aside. Thought one to back into the eighties, an everyday financial price are anywhere between ten% and you may 18%, and you will a beneficial 8.x% rates does not hunt also crappy, relatively. Without a doubt, the cost of a house has risen since that time, but home loan prices are nevertheless dramatically less than they might feel.

The way to get a decreased financial rate

Sadly, you don’t have significant amounts of private control of the brand new mediocre interest rates offered at any given big date. However do have a lot of control over brand new rates you will be considering in line with the common.