Frequently asked questions

A mortgage is actually that loan open to business owners and salaried someone with the acquisition of a property to reside. Users can decide to have a house built on the house, expand their existing home with the addition of the ground, get a resale flat/independent house, get yet another flat/separate home off a creator or import the bill off good mortgage availed from yet another standard bank.

KYC files (Target Proof such as Aadhaar card, Latest household bill, an such like.; Identity Research instance Pan Card, Operating Permit, etcetera.) and family savings statements are compulsory. For entrepreneurs, evidence of providers facilities becomes necessary. To possess salaried customers, the very last 3 months’ pay glides and you may Setting sixteen are expected.

To apply for a home loan you must be no less than twenty one if financing several months starts and cannot go beyond an age of 65 age when the loan finishes or during superannuation.

Sure you might apply for a shared mortgage together with your lover otherwise quick relatives such as your moms and dads and you will youngsters. Household members or any other contacts do not meet the requirements once the a joint candidate along with you.

A floating interest fluctuates otherwise transform as well as market conditions. If one chooses a drifting rate of interest the guy/she turns out spending an alternate EMI matter anytime the newest foot price change. Which rate could boost in an increasing rate of interest circumstances and vice-versa.

Repaired price home loans are supplied on a predetermined interest rate into the loan period that are nevertheless undamaged in the mortgage period irrespective of field criteria.

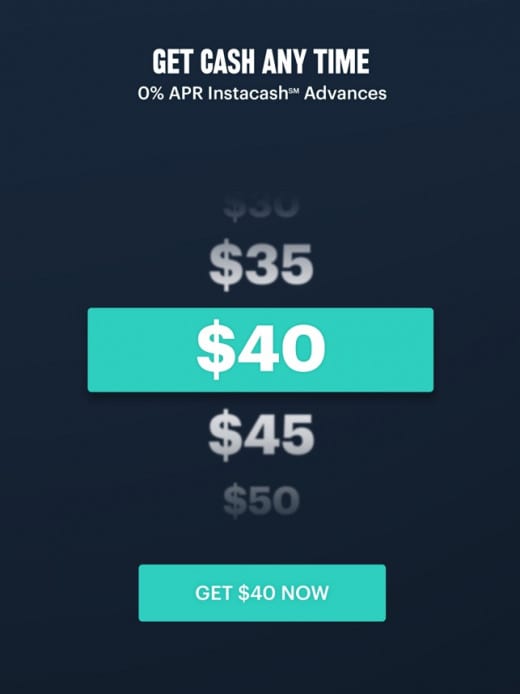

Quick loans in Littleton Resource

Yes you’ve got the option of modifying out-of a floating speed so you’re able to a predetermined speed home loan as well as the most other way as much as. Fees is generally applicable having altering regarding repaired to help you floating rate.

Their EMI could be subtracted directly from your bank account through to registration of your mandate that have NACH (National Automated Clearance Home).

Sure, you can repay the mortgage count in advance of completion of one’s scheduled financing tenure if you are paying from the number a good. Prepayment costs tends to be appropriate in line with the financing method of and you can character from closing.

KYC documents (Address Proof such Aadhaar card, Most recent household bill, etc.; Title Evidence like Dish Credit, Riding Permit, an such like.) and checking account comments is actually compulsory. For entrepreneurs, evidence of team establishment is needed. To have salaried consumers, the final 3 months’ shell out glides and you can Setting sixteen are required.

Yes, you get a taxation deduction or any other financial professionals. Under Section 80C, you might allege write-offs doing Rs. 1.5 lakh for the dominating fees carried out in the latest financial season. Less than Part 24B, you could allege deduction for Rs. 2 lakh into the accrual and you can percentage of interest on an effective home loan. Regarding a combined financial, for every debtor can be claim a good deduction from principal repayment (Area 80C) and you can appeal fee (Area 24B) if they are plus the co-people who own the home. The above info is a summary of relevant terms according to the Tax Operate. Delight investigate alarmed tax arrangements in more detail or demand income tax advisers for an entire understanding of this new effects.

When you have an existing financial while having generated timely costs into current home loan, you can aquire the option of credit an extra financing. This is known as a high-up financing. The interest prices toward a premier-right up loan is below a personal bank loan plus it demands very little records in order to processes which mortgage plus the currency can be used for a variety of costs.

A mortgage was an extended-title financing (as much as 2 decades tenure). And this, lenders have to guarantee that they’ll obtain cash return in the long run. For this reason, the mortgage sanctioning power will check your credit rating ahead of sanctioning a home loan for your requirements. But not, in the Chola, this isn’t required to possess a credit rating and you can earliest-big date borrowers are eligible for loans.

There are numerous version of home loans depending on your specific requirements. A number of the trick of these are as follows: Self-Construction: Such loan try provided to people to your design off a home on a parcel of land that they individual. Purchase/Resale: These types of financial was offered to people who would buy a current property (Flat/Independent house) regarding the earlier owner. Pick a unique house on developer: These types of financial was supplied to prospects to purchase a different assets (Flat/Independent home) throughout the builder. Household Expansion/Extension: This loan is actually especially offered to prospects who wish to grow its newest the home of become yet another build for example an more flooring, room, toilet, etc. Harmony Transfer: Anyone who has already availed a mortgage out of an alternate financier should transfer the rest balance to a different financier. The house or property is actually cherished once again thin private ount than the balance (Top-up) when you’re planning for an equilibrium Import loan. Store Loan: These lenders try offered to acquire or create a store/commercial facilities. On Chola we provide funds for your commercial properties.