Family security mortgage pennymac

- PennyMac mortgage review |.

- PennyMac Financial Remark to possess 2023 | The mortgage Profile.

- PennyMac Mortgage Remark 2023 | LendingTree.

- Pennymac Financial Feedback 2023 – NerdWallet.

- Home Guarantee Personal line of credit (HELOC).

- PENNYMAC – National Mortgage.

- PennyMac.

- PennyMac Domestic Security Mortgage Remark .

- Pennymac Mortgage Remark 2023 – Company Insider.

PennyMac home loan feedback |.

Secure & Store makes it possible to protected your rates ahead of pricing possibly go up even further and you may one which just come across your property. Additional information Rescue $step one,000 Rating $step one,000 for the your settlement costs. Get pre-acknowledged and cut. Save your self now The home to invest in techniques shall be challenging. Affect we from gurus getting your ex lover! Let’s name you. Home Guarantee Loans | Pennymac Family Collateral Funds Property equity financing are proper for your requirements if you prefer an enormous increase of cash or try paying highest notice loans. Change your.

PENNYMAC – Federal Home mortgage Bank Celebrating fifteen years from homeownership, together. Find out more Pick Instant Rate Estimates Get in touch with financing Manager Homebuyers. Household guarantee loans are a helpful way to utilize the new security of your house to locate loans in the event your possessions is tied up on your possessions. They have been fundamentally offered by straight down rates of interest than many other different consumer fund as they are safeguarded by the home, such as your no. 1 financial. Pennymac are an internet financial one develop mortgage loans in all claims but New york. It has got compliant, FHA, Va, USDA improve refinances, jumbo, and family collateral finance. While you are a great.

PennyMac Home loan Opinion 2023 | LendingTree.

Pennymac excels inside the bodies-supported mortgages, and FHA money, and allows you to buy pricing on line. However, average origination fees are on the better avoid, plus the financial will not give. Pennymac even offers jumbo financing solutions with different terms to make it easier to buy a luxury family. Borrowers that have a credit rating regarding 700+ , 9-to-1 year from supplies, and you will a great 75-% Loan-to-Really worth (LTV) ratio are eligible getting amounts up to $step 3 mil. Before you could consider making an application for a property equity loan, its a good idea to see the earliest requirements. Without the lenders have a similar requirements with regards to so you’re able to qualifying to own a property equity mortgage, listed here are common home guarantee financing standards. A minimum of fifteen to twenty percent equity of your house. The absolute minimum credit rating regarding 621.

Pennymac Home loan Remark 2023 – NerdWallet.

The average 30-season fixed-re-finance price is six.38 %, off 11 basis affairs during the last day. Thirty days before, the average price to your a thirty-season fixed refinance was highest, at 6.48 per cent. From the. PennyMac try a leading all over the country home loan company with a credibility away from low pricing. But is they right for you? Financing autonomy cuatro.5 Customer service 4.5 Easy app 5 payday loans Borrego Springs.0 On the internet feel.

Family Security Personal line of credit (HELOC).

PennyMac try gaming to the possibility home based equity financing, announcing Friday that its Mortgage Features subsidiary tend to now provide HELOCs. The company said its. What exactly is property security mortgage? House equity is the part of their house’s worth you own just like the you already paid down it well. When your home is well worth $2 hundred,000 and you also are obligated to pay $100,000 on the financial, you really have $100,000 home based collateral. Property equity loan enables you to use your household security once the guarantee for the a separate loan.

PENNYMAC – Federal Mortgage loan.

Log on to Implement otherwise Manage your App On the web | PENNYMAC Manage your application online using my Home Because of the Pennymac. My personal Home From the Pennymac commonly assist you by way of each step out-of the program procedure – it is therefore very easy to use anytime, anyplace and you will away from any unit. Sign on Not registered?.

PennyMac.

The blend out-of shorter principal and you may increasing market value often means extreme security is present for your requirements, the fresh new homeowner. When was the past big date your spoke so you can a licensed Financing Officer regarding your choices for getting one to collateral to get results to have your? Call (888) 978-2075 Start-off You could potentially come back to your house webpage or register once again.

PennyMac Home Guarantee Mortgage Feedback .

Pennymac try a national home loan company that really does company having borrowers throughout 50 states. Its loan choices are traditional and you can government-insured financing (FHA, Virtual assistant and USDA), also. A house guarantee loan enables you to sign up for one minute mortgage by credit facing your existing collateral. You can always acquire to 80% of this collateral. Qualifying is actually.

Pennymac Mortgage Comment 2023 – Team Insider.

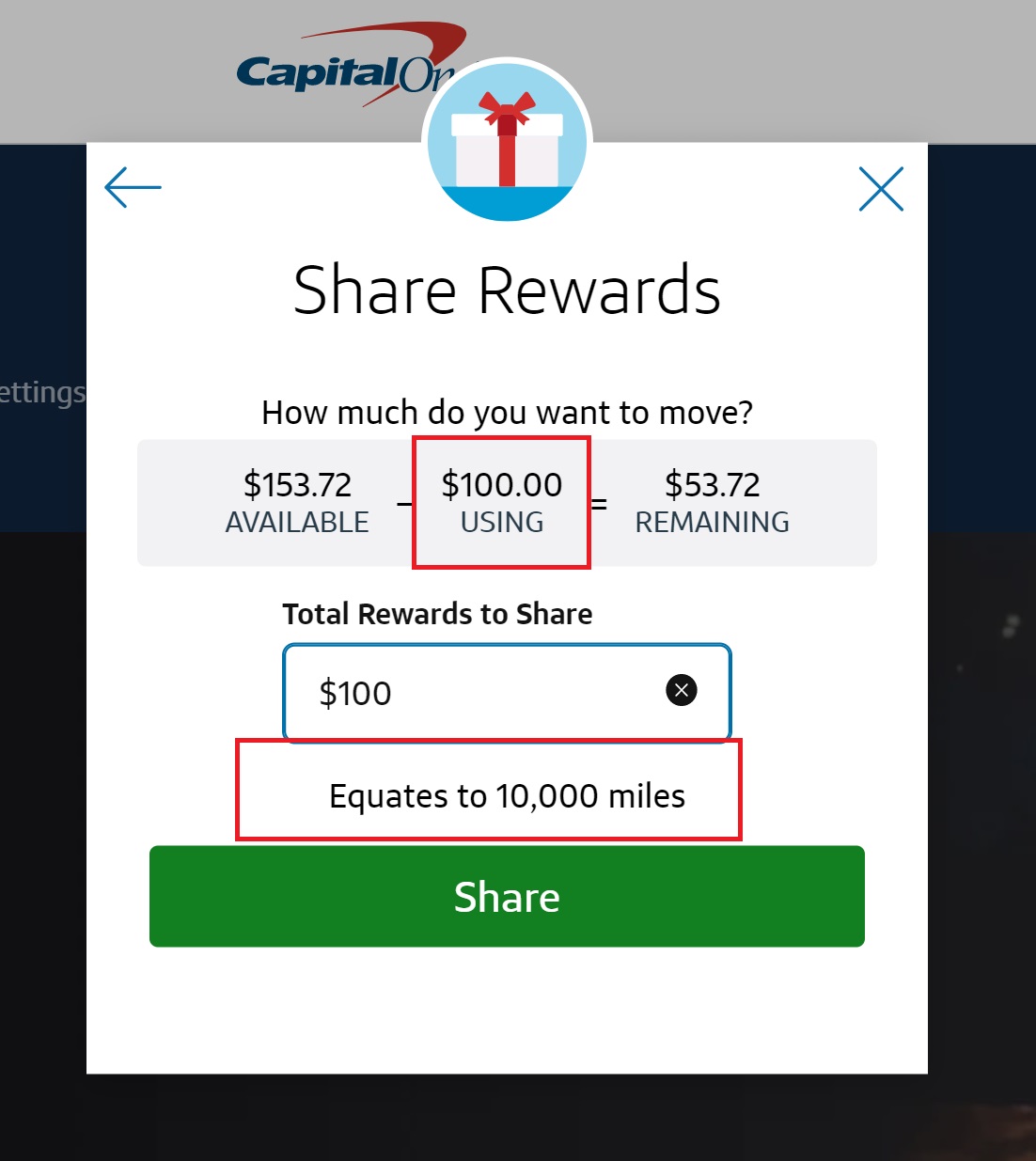

Eastern Standard Day. WESTLAKE Town, Calif.– ( Business Wire )–PennyMac Economic Properties, Inc. (NYSE: PFSI) now revealed this new release of a home Collateral Collection of.

PennyMac Financial Functions, Inc. Account Last Quarter and you will Complete-12 months.

A property security mortgage regarding PennyMac could will let you obtain an enormous lump sum of cash at the a somewhat low-rate. Jumbo Jumbo fund allow homeowners in order to borrow more than new compliant financing maximum in the region. PennyMac brings mortgage loans doing $step three billion, however, eligibility criteria are stricter. Unique apps. PennyMac was a national home loan company based for the Westlake Village, California and founded for the 2008. Its one of the best rated businesses in its business, having.

PennyMac Financial Properties, Inc. Releases Family Collateral.

To possess money spent fund, PennyMac demands a down payment out-of 15% so you’re able to twenty-five%, with regards to the particular property. it states you have an effective or sophisticated credit and a great DTI proportion of zero. Property security loan is a fundamental 2nd mortgage, a-one-time mortgage that provides a lump sum of cash which you can use for anything you wish to. Using this type of style of.

PennyMac Economic Features, Inc. Launches Home Security Lending Product.

You could potentially reach Pennymac’s transformation cardio at 888-870-6229 off 6 an effective.m. in order to seven p.m. Pacific Day Saturday courtesy Tuesday and you will six a good.m. to 5 p.meters. Friday. If you have questions about your mortgage account. PennyMac Financial (PMT) made an appearance having an effective every quarter loss of $0.07 per display as opposed to new Zacks Consensus Imagine from $0.39. That it even compares to loss of $0.twenty-eight per show last year. These types of rates was. This new Pennymac Home loan Blogs is where you can find objective, useful info to aid save a little money, some time peace of mind inside the financial procedure. For those who have.

Investment property Funds – Eligibility,.

PennyMac offers many financial products that will likely be used for re-finance into following a couple of fundamental selection: Cash-away refinance. Alter your loan which have a home loan for over you borrowed to help you tap into their residence’s security for the money. PennyMac also offers old-fashioned, FHA and you may Virtual assistant bucks-aside refinancing facts. Rate and you can term re-finance.