No savings are required. The lending company totally funds the acquisition of your own brand new home. What you need to value can be your month-to-month home loan repayments. Sounds high, does it not?

Such loans have the potential to create consumers so you’re able to safe a great property you to definitely most other banking companies won’t envision offering them financing into the. Plus Cayman’s most recent market, frequently it’s the only path anybody access it the latest assets ladder.

Extra Bills

For the reason that the rate at which the lending company commonly fees you notice is much high. Just what you get paying the bank in total desire (how much cash paid off on top of the price along the identity of the loan) is much better.

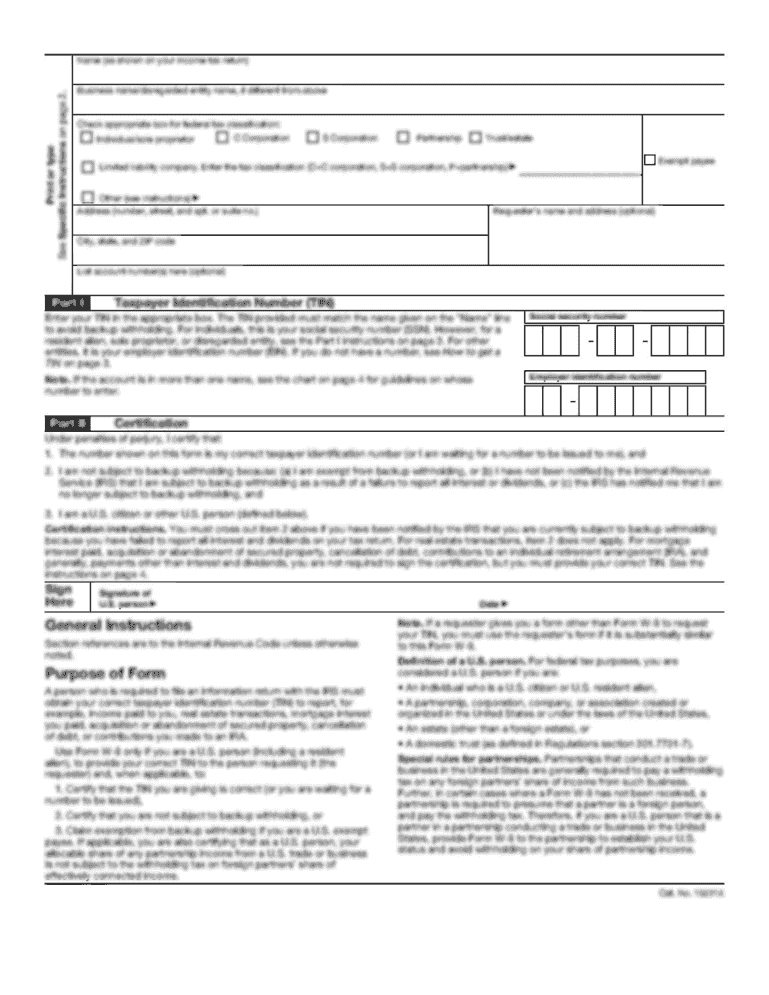

Lower than is actually a side because of the front comparison away from 100% financing and a basic loan. This example lies in current prices to invest in a keen Isabela Estates homes package, indexed at the CI$29,700 throughout the Cayman Brac.

The financial institution was of course, if greater risk whenever giving 100% resource. As a result, it costs a high interest to make certain they generate its cash back. So when you don’t need to give fund upfront, you sooner pay a lot more into the assets.

The pace therefore the total attention along side loan name are only one or two circumstances you need to thought when comparing funding alternatives. To own general details about mortgage loans, We advice you to read my personal prior writings: Mortgages for the Cayman.

Extra Some time Fret

In my experience, the latest organizations providing 100% money mortgage loans wind up postponing assets conversion process. Just how long ranging from should your Render was accepted so you’re able to the newest Closing go out might possibly be a lot longer and sometimes significantly more exhausting – for everyone parties involved.

If it is not a location Classification A lender regarding the Cayman Countries, actually “pre-approvals” do not always guarantee your that loan. Your loan application have to get across numerous desks, and in some cases, go off-isle instant same day payday loans online Iowa ahead of they are able to establish the loan.

Unattractive Offers to Sellers

Vendors might be evaluating your own Provide to acquire in order to someone else. Without a doubt, rate may be the most significant choosing basis, although amount of standards, the brand new timeline to close off, additionally the type of funding normally influence if or not a seller allows an offer.

Enough time and you will worry that accompany 100% financial support mortgages you are going to deter vendors from recognizing the Bring. In a nutshell, the lending company you decide on is place you missing out.

Given that a purchaser, this may getting discriminatory. Why should the vendor care and attention your location getting the financing off? Place yourself from the Seller’s footwear. If they undertake the brand new income of the possessions inside a couple of months versus five weeks and give a wide berth to unforeseen factors, delays, and you may worries, next however, they will certainly proceed with the extremely uncomplicated Give. They need to mark their residence off the market whilst you sort out your own requirements big date that can be lost in the event the financial isnt accepted.

Put Still Requisite

In initial deposit, otherwise just what specific will get name serious currency, is how people inform you manufacturers they are not only wasting time. It is like a security put on the selling itself – whether your income experience, you earn your bank account back when you find yourself approved to possess 100% funding. However, you nonetheless still need to obtain the finance in your account, willing to lay out when you make your Give with the provider. This type of funds was following kept within the escrow (another carrying account) till the property transaction is complete. Unfortuitously, it is not strange, especially for basic-big date consumers, lured because of the 100% investment from the bank, to miss wanting funds towards the put.