Centered on Investopedia, the increase regarding the monthly installments for the a two/twenty-eight attract-only subprime Sleeve will likely be dramatic when comparing to a fixed-rated 30-year home loan. Such as for example, if you purchase an excellent $350,000 house and place down $fifty,000, you may have a great $3 hundred,000 2/twenty eight Arm home loan having a primary interest of five percent. Your monthly payments can begin out around $step one,900, just in case your home taxes go for about $230 a month and you may home insurance concerns $66 a month.

If your interest remains 5 % for 2 age, up coming goes up to help you 5.step 3 per cent, their homeloan payment manage boost so you can $1,961. Immediately after one or two so much more decades, the pace would-be adjusted twice a year, usually uppare that with a thirty-season repaired-rate home loan on a single mortgage which have 5 % attract, you might pay $step one,906 per month indefinitely.

While it’s usually possible in order to refinance following a couple-season months, the fresh lowering of admiration philosophy regarding You.S. housing industry when you look at the casing chest produced that it hard. You’ll want to understand that any time you refinance, you ought to pay another type of group of closing costs to your lender.

This is why if you decide to pay the mortgage away from very early, you need to pay most fees. And subprime funds may possibly keeps a beneficial balloon commission attached, which is when the history payment try intentionally larger than previous money.

Not all information was crappy in the wide world of subprime financing. You to definitely nonprofit providers entitled NeighborWorks America has been doing things regarding it. Through its Financial Recovery & Foreclosure agency, the business teaches foreclosures advisors to assist individuals and you can upgrade teams of their choice.

NeighborWorks got action immediately after studying you to a common problem between subprime lenders as well as their members try deficiencies in communication because the debtor falls to your financial payday loans Triana straits. Have a tendency to, the borrower is actually ashamed or frightened to-name their unique bank, although there is strategies that will be taken to stop foreclosure. Lenders usually have troubles locating the members of necessity of suggestions.

Lenders may consider financing high-risk to possess borrowers who, while they has actually a good credit score ratings, are unable to render proof of income and assets, or borrow an unusually large part of their earnings, also all kinds of almost every other explanations [source: Brooks]

This new radical rise in what number of non-payments and you can property foreclosure on the subprime mortgage loans beginning in 2006 resulted in a beneficial subprime financial drama. By , one out of five subprime mortgages was in fact unpaid having 31 % away from Fingers was absolutely delinquent. It in the course of time triggered $7.cuatro trillion inside the stock exchange paper loss, and you will eliminated in the $step 3.cuatro mil from inside the a residential property riches.

The brand new blame toward subprime home loan drama try mutual certainly numerous circumstances. Many home loans steered their clients into the financing it decided not to manage. More about, individuals were likely to home loans to act given that wade-ranging from. The effect try market that was not myself responsible when a great loan happens bad. Lenders don’t endure people penalty when a loan they drawn up defaulted, so there was not much bonus to make down candidates contained in this commission-established globe.

In the past, when someone wished that loan, he/she would go to the financial

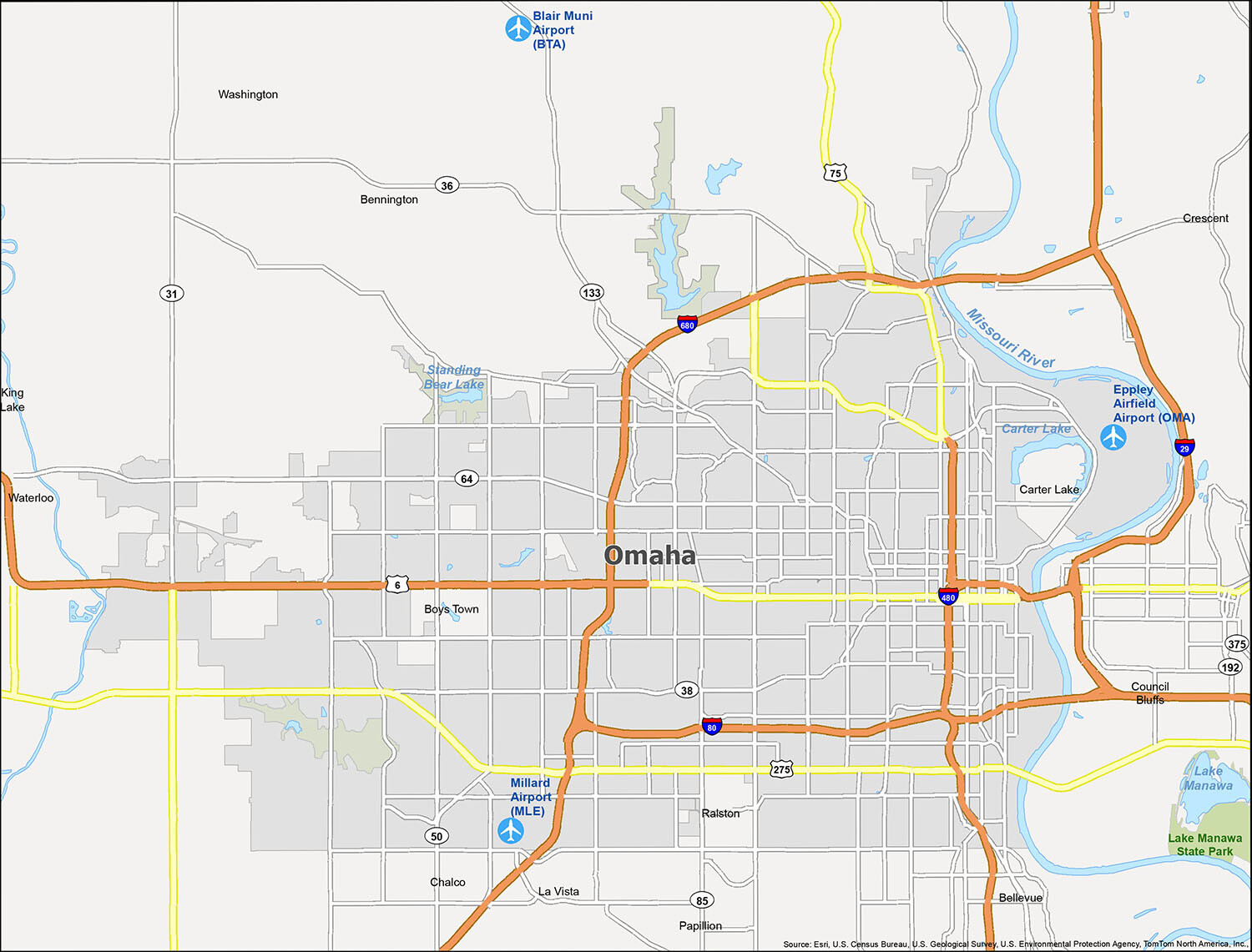

This new jobless speed was also something ultimately causing the newest crisis. Midwestern says hit tough from the vehicles industry layoffs rated one of several higher into the foreclosure [source: Government Set aside]. The majority of people is relying on to be able to re-finance in order to make their financing reasonable, but reducing enjoy costs regarding the housing market caused it to be hard otherwise impossible. Just like the introductory several months for the subprime fund went out, the fresh costs was more than many could manage.