Ever wanted getting your own house however, concerned with the newest downpayment or your credit rating? A keen FHA Financing may be the primary the answer to open their fantasy. Recognized for its value and freedom, FHA Funds was a government-backed home loan alternative that can make homeownership a real possibility for the majority of first-date homeowners and people with average credit scores.

Let’s start out with an overview of FHA Loans after which mention how they can help you achieve your homeownership desires.

What is an FHA Financing?

Imagine home financing program which allows that get a home that have a deposit only step 3.5% . This is the energy regarding an enthusiastic FHA Loan.

Supported by the Government Houses Administration (FHA), this type of financing enable loan providers to give more relaxed standards since FHA insurance coverage protects them in case there is mortgage standard, putting some path to homeownership a lot more accessible for some People in america.

Insights FHA Financing Gurus

- Low down Commission : With just 3.5% down, you can end up being a homeowner, freeing up extra cash supplies with other swinging-inside will set you back or future renovations.

- Flexible Borrowing from the bank Criteria : Unlike Traditional Loans , FHA Financing do have more easy credit score standards. Basically, a credit score on the middle-600s will help whenever being qualified to have an FHA Loan, towards the lower 3.5% down payment choice.

- Multiple Financing Choice : FHA has the benefit of individuals financing choices to suit your needs. New FHA 203(b) Financing is the most well-known choice for to purchase one-home. If you’re looking in order to upgrade a good fixer-top, the fresh new FHA 203(k) Mortgage may help money the purchase and you may renovation will cost you.

FHA Financing Criteria: A definite Photo

- Earliest Standards : You’ll need to be good Us resident that have a legitimate Societal Coverage count and you will intend to occupy the home as your first residence.

- Financial Criteria : The debt-to-money (DTI) ratio, and therefore compares their monthly personal debt repayments into gross income, is an important basis. Essentially, FHA Financing get a hold of an excellent DTI ratio less than a particular threshold. You’ll find a lot of resources online to determine your own DTI .

- Credit history : As stated prior to, a credit score about mid-600s generally speaking allows you to be eligible for the 3.5% deposit option. However, strengthening and you will maintaining increased credit score can lead to most useful interest levels on your own loan.

Knowledge Financial Insurance policies that have FHA Financing

Discover an additional cost regarding the FHA Finance called the Mortgage Cost (MIP). It advanced will act as a security blanket into financial, making certain they are safe for folks who standard to the financing. There are 2 types of MIP.

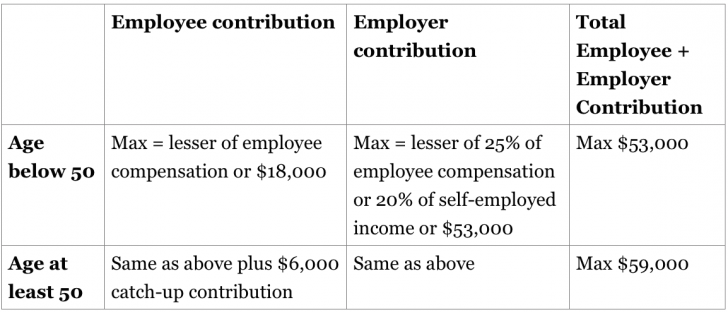

Here is a summary table of these two types of MIP relevant having FHA Funds, in addition to their commission timing and you can duration:

personal installment loans in Alberta

FHA Financing Restrictions: Understanding The choices

There are limit financing wide variety getting FHA Money, hence will vary with regards to the condition what your location is to shop for. Thankfully, trying to find your unique loan limitation is straightforward. The brand new FHA website now offers a hack to dictate the fresh new FHA Mortgage restrict for the town.

Not in the Maxims: FHA Funds getting Experts

Our very own country’s heroes are entitled to all the support they’re able to get when it comes to homeownership. FHA Money are going to be a good selection for pros as a result of its flexible requirements and potential for down-payment guidelines. Definitely, Va Money include of many center masters more other kinds of lenders.

Here at DSLD Financial, we have been willing to streamline the process for experts and discuss all the available options while making their homebuying excursion effortless and you can successful. Yet not, we might constantly thought Va Loans for those who have an army record otherwise try an eligible armed forces spouse .