Are a pops try a difficult, overwhelming and pleasing time in everything. There clearly was much to arrange to possess and will also be juggling of a lot various other roles, as well as caregiver and you can merchant. If you decide to become a stay-at-house mother, or it will become the most suitable choice for you while in the specific season away from lifetime, you’re thinking how you can continue steadily to manage and help make your credit.

When you are performing region-time to earn money is actually a choice-such as flexible remote work-it is not always achievable for everybody, specifically which have a child. In this article, you will learn throughout the certain methods continue steadily to create borrowing because a stay-at-household parent.

Ways to generate borrowing from the bank without a full time income

Since the another type of father or mother, there are lots of things would need to lose, and, a great deal which you are able to get- not, your borrowing from the bank need not be one of many points that suffers. Here are some methods for you to continue to build credit because the a stay-at-domestic father or mother in the place of a living.

Be a 3rd party associate

A good way you could potentially still build borrowing from the bank given that a stay-at-home moms and dad without a full time income is to getting a third party member. Such as, in case the mate is actually operating, they could add you since an authorized representative on the credit card. This should will let you make use of the card because if it have been the. The primary account owner (in such a case, your partner) carry out still be guilty of making the money, but your identity is likewise on the account and gives you which have a chance to make borrowing from the bank. How it work is the fact that the credit rating of these credit is the credit score on your own credit file for as long as you remain an authorized associate.

Bear in mind if you are consider the options you to, due to the fact a third party associate, their credit could go one of two suggests. It might alter your borrowing from the bank (in case your no. 1 cards proprietor was responsible that have and come up with their monthly payments) or hurt your own borrowing from the bank (whether your no. 1 cards holder is actually irresponsible and defaults). As a 3rd party associate, their borrowing are influenced by the primary cards holder’s behavior as the it pertains to their borrowing from the bank, costs and you will monetary government.

Consider utilizing appropriate credit cards

Even if you don’t have a constant money, you could potentially continue using their playing cards in many ways you to definitely help you. This includes playing with credit cards that offer advantages having facts such as for instance groceries, energy and you may food. Which have increasing people, possible certainly end up being and work out reoccurring purchases that will possibly seem sensible to earn you perks, discounts or other pros.

These types of cards may include shop playing cards (particular to a specific store or chain of stores inside an excellent network) otherwise handmade cards that could include specific advantages otherwise all the way down annual payment cost (APRs).

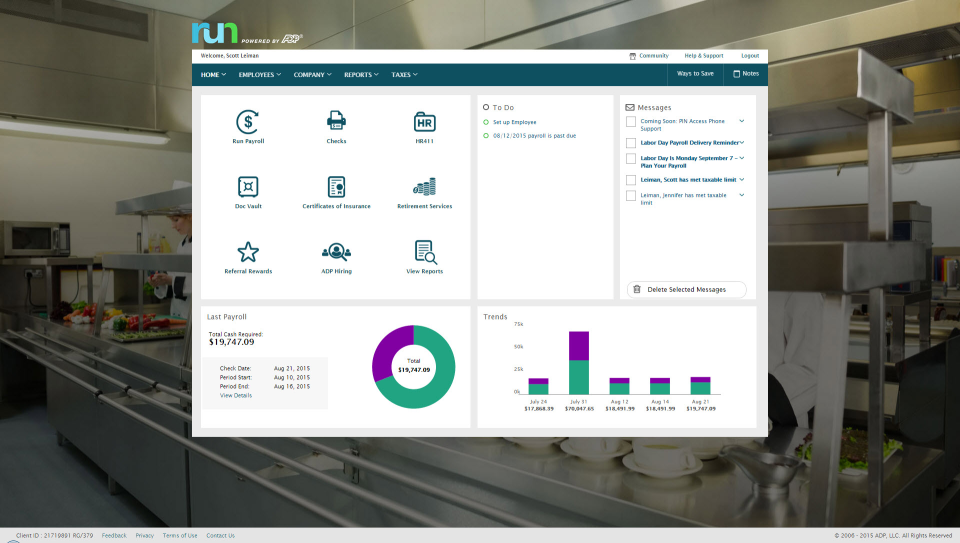

Explore totally free units https://elitecashadvance.com/installment-loans-nc/milwaukee/ such as Pursue Credit Travel to assist you

Having a baby mode enough extra expenditures-you’re probably looking to save will set you back preferably otherwise was thinking how you can keep the credit rating amidst all this new costs. Contemplate using free online tools instance Borrowing from the bank Travels in order to display and you may potentially change your credit rating. You should buy a personalized package available with Experian so you can do so to switch your own score in order for it’s in an effective reputation prior to and you can during the parenthood.

- Discover a free, up-to-date credit history as frequently since all seven days

- Display screen and song your credit score through the years

- Subscribe borrowing from the bank keeping track of and you may term keeping track of notification to help keep your information safer

- Leverage free instructional info to assist greatest see your credit score

- Utilize the borrowing from the bank planning function so you can map your own coming credit rating

Place tools and other properties in your name and pay them every month

Whether you’re producing income away from another provider or discussing your own lover’s money to cover expenses, put power bills and repeating costs below your term to create up your commission background and use a charge card to pay them regarding. But guarantee so you’re able to budget carefully of these particular continual expenses.

Commission records is actually a major factor that becomes felt when figuring your credit score. Building up a powerful, uniform percentage history can assist you to build borrowing from the bank because the an effective stay-at-family parent. While you are while making your instalments punctually, this is certainly an effective way to aid replace your borrowing from the bank get throughout the years.

Discover a combined account with your spouse/mate

In the event the spouse offers an income source and you can takes out that loan, envision getting the name detailed alongside theirs. Beginning a joint membership along with your companion (such as for instance an auto loan) might help broaden your levels, that will alter your borrowing blend. This will help you acquire trustworthiness on vision from lenders that assist make a more powerful credit history over the years.

Strengthening borrowing from the bank once the a single mother or father in the home

While one, stay-at-home-mother, may possibly not getting feasible to accomplish all of the significantly more than. You may want to believe looking into one types of authorities professionals which could connect with your.

While perception overwhelmed or perplexed, always reach out to the folks just who care about your getting support. Speak about certain options having family unit members through to the baby appear therefore you’ll have an agenda set up, for example who will assist view your child although you work.

To conclude

Become a parent try an exciting day, and the final thing you want to care about since you prepare for parenthood ‘s the state of one’s credit rating. You might avoid stressing precisely how your credit score has been doing of the being proactive and diligent, leaving you additional time to a target she or he.