Katrina Avila Munichiello is actually an experienced editor, publisher, fact-examiner, and you may proofreader with more than fourteen several years of feel dealing with printing an internet-based courses.

Picking out the finest family for you is an aspiration come true, you would be set for a rude awakening when you’re perhaps not prepared to pounce after you view it. Before you go searching for one to household, you have to do particular work with get better to get able to protected the offer.

Precisely what does that mean? It means preserving right up an acceptable down-payment, pinpointing suitable lending company, checking your credit score, minimizing the money you owe, putting aside bucks to possess settlement costs, and getting pre-recognition having a home loan ahead of time.

Secret Takeaways

+CAN+SAVE+YOU+CASH!+.jpg)

- Make sure to possess an adequate advance payment; 20% of your purchase price is actually basic.

- Shop around in advance to target an informed lender having your.

- Look at the credit history and you Mountain View loans may boost it if necessary to obtain a knowledgeable mortgage rate.

- Make sense your own overall an excellent financial obligation and you can slim to.

- Hide aside 2% to 5% of one’s prepared purchase price to fund closing costs.

- Get pre-acceptance from the selected lender.

Almost thirty two% paid back cash to have a house in 2022, depending on the a residential property webpages Redfin. That is a sizeable boost regarding only 24 months in advance of, on level of your own pandemic, in the event it involved 20%.

Which is sweet in their eyes. An almost all-cash customer has a bonus more than anybody else in the event that you’ll find numerous people wanting your house.

But not, two-thirds of your own homebuying sector doesn’t have that kind of bucks. These types of consumers is homebuyers within twenties, only beginning in the position industry, or any other basic-day homeowners. The significance of progress preparing gets all the more urgent.

The six procedures lower than can help equivalent the newest playing field for your. Especially the history action: Get home financing pre-approval ahead. It isn’t a joining document, but it notice the vendor you to a loan provider has actually assessed the financial things which can be in a position and prepared to offer your an excellent home loan up to a particular top.

6 Packets to evaluate

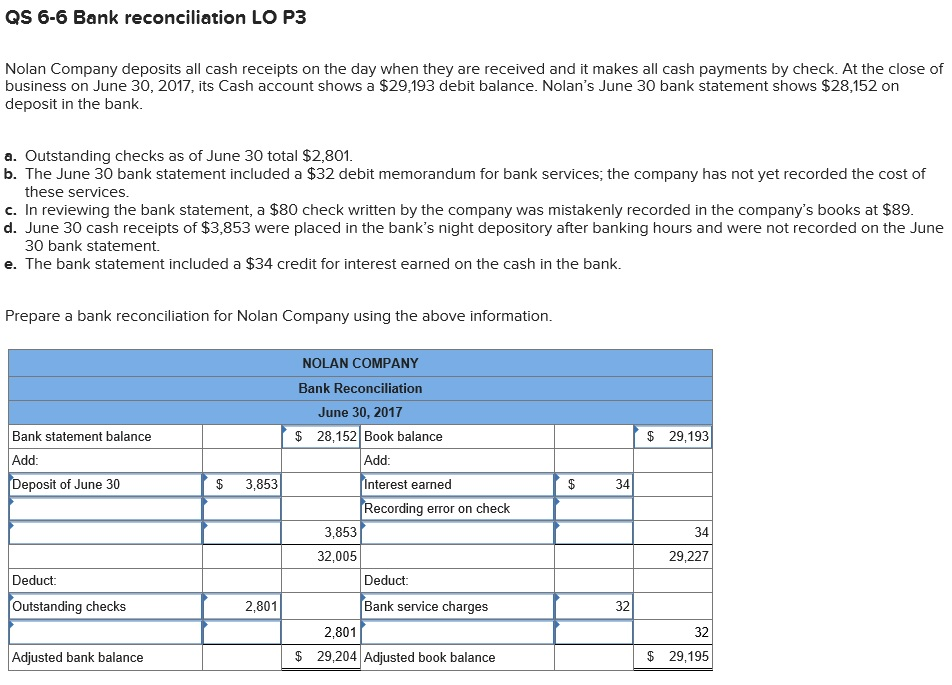

The process may vary certainly one of lenders but in all instance, you will find six packages to check of when applying for a good financial: Get your advance payment together; come across a loan provider, look at the credit score, check your loans-to-income ratio, kepted closing costs, and apply to have pre-recognition away from a mortgage.

You might add a agent compared to that number. Eighty-nine % of people who purchased a house during the 2023 told you it receive a representative become helpful in new techniques.

Crucial

When deciding on a realtor, look at the individuals records, back ground, and you will feel. Asking family and friends to own recommendations can help you get the best elite group to do business with.

Requirement #1: Gather the latest Advance payment

The first demands to acquire a house is a down-payment. This is actually the money you have to pay upfront so you’re able to counterbalance the matter you need to borrow.

Lenders provides fasten the requirements since the overall economy for the 2008, says Karen Roentgen. Jenkins, president and you may President of KRJ Consulting. As a result, potential consumers looking to pick property need to have some skin throughout the game’ to help you be eligible for a property.

For the very best rate offered, you have 20% to place off. Which also can help you forget about individual mortgage insurance, and therefore adds to your month-to-month will cost you later.

If you don’t have that type of money, consider examining your own qualification getting a federal Houses Administration (FHA) loan. The service needs merely an effective step 3.5% advance payment. Having FHA acceptance, you should buy financing out-of a financial toward federal agencies acting as the mortgage insurance provider.