We all like paint all of our domiciles because transforms them to the land. It is like respiration a special lifestyle in the place and you will so it’s more comfortable so when attractive as you would like it is. not, house restoration normally burn off a hole on your pouch because of it is oftentimes high priced. While there is plenty of demolishing and you will dismantling doing work in the process in which labour needs to work day and evening with right thought. But what do you manage if you’d like to upgrade the newest household just before an event otherwise a significant setting and you’re quick to the money?

Better, in such cases, you can always get property recovery loan. Aside from and then make your property hotter and you will attractive, this type of family makeover finance can supply you with of numerous prospective income tax pros. So, on this page, i will be knowing the principles off family renovation capital and you may the new taxation great things about they.

What exactly is a house Repair Mortgage?

As stated prior to in the inclusion, house recovery money is financing that you grab of some financial associations or finance companies with the makeover of your property. These types of financing are specifically built to make it easier to complete your house repair wants. And therefore, it safeguards everything you ranging from repairing their drawing-room so you can restoring leakages and you may offering the kitchen a modern-day makeover so you can color the wall space of your home. These types of finance, overall, bring a convenient answer to financing your work rather than emptying your own discounts.

Income tax Write-offs Towards the Domestic Recovery Loan

When you choose for a property recovery financing, you just bring your home a transformation also discover the doorway to help you possible tax pros. Yes! There are numerous income tax professionals you might avail by using domestic recovery financing, and you will save a large number of cash in a year. The government will bring these incentives to help you meaningful link remind homeowners to shop for the properties since it somehow causes the economic growth of the world. Here you will find the taxation advantages of house renovation fund:

Notice Write-offs

Among the first benefits of a home restoration financing try this new deduction with the attention reduced. The interest of your house reount is approved having income tax advantages lower than Section 24(b) of your own Tax Work. This means you could reduce your nonexempt earnings toward assist of focus paid back on loan throughout a financial 12 months. However, keep a note the limitation count enjoy to own deductions is ?31,000. Thus, this is one way your house repair taxation offers performs.

GST Benefits

Yes! You additionally have GST benefits into the family renovation loans. Products or services Income tax, or even named GST, is a big facet of any economic exchange, whether it’s home repair loans or any other types of mortgage. Therefore, when you take financing getting restoration, this new GST paid off on various products or services connected with the brand new enterprise shall be qualified to receive tax gurus. Beneath the Type in Income tax Borrowing (ITC) system, the new GST paid back into the raw materials, labor, or any other features is going to be well-balanced resistant to the GST with the overall solution. It will help in reducing all round income tax load from the your own do it yourself.

Low interest rates

You certainly do not need to invest highest rates of interest to your family repair financing as the interest levels are very competitive compared to what you’ll get that have handmade cards and other fund. Hence, your current can cost you will be dramatically reduced than you’ll assume these to end up being.

Brief Disbursal

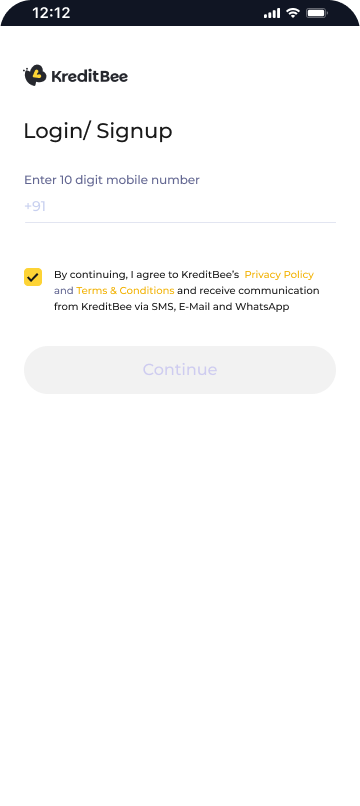

Domestic recovery unsecured loans are disbursed quickly in comparison with other types of money, specifically if you go for on line finance.

Limited Papers

Family renovation financing will become approved with reduced files. Usually, you simply need the program, money research, financial statements, passport-proportions photographs, and identity proof to obtain the household recovery mortgage.

step one. Just what prices are included in family renovation money?

The major can cost you secure when you look at the a property restoration mortgage is services for color, fixing leaks, upgrading fittings, and you will restoration bed room. it may tend to be prices for adding new bed room, upgrading the kitchen, reorganizing brand new washroom, etc.

2. Who’ll sign up for a home recovery mortgage?

Whoever has property and would like to make advancements is also apply for a property recovery financing. But not, the latest applicant has to meet the mortgage eligibility conditions to acquire the funds. Anyone more than 21 years old with the very least monthly money out of ?fifteen,000 and you can a good credit score can put on having a property renovation loan which have CASHe.

3. Exactly how much house renovation loan taxation work for is it possible you rating?

You can get a taxation advantageous asset of around ?31,000 to the attract you pay to possess property renovation loan. It will help lower your taxable money and you may save some costs for the fees.