..A short-term answer to lower your outgoing expenses and additionally do a short-term money cures (elizabeth.g. if you are getting adult get-off or using college tuition while you are studying)

If you’re going attention-just doesn’t make sure approval if you are discovering, it can make their mortgage payments less expensive toward course of knowledge.

Specific college students may feel they [repaying interest-only] could be advisable to help perform lower costs whenever its earnings is lower, and they can change to dominating and you may interest after they have been in a higher purchasing employment, Ms Osti said.

But not, we might maybe not recommend users to try to get a home loan if they could not spend the money for dominating and you may appeal costs.

Use the Household Guarantee Plan

You might be able to be eligible for regulators help when you find yourself buying your earliest family, like the Earliest Household Guarantee. According to the First Household Ensure, basic home buyers can find a property having in initial deposit just like the reasonable once the 5%, without the need to shell out Loan providers Home loan Insurance rates (LMI).

Applying for it bodies make certain is help you to get recognized having a mortgage when you’re discovering, due to the fact there is nothing on the eligibility criteria outlawing pupils off using. The needs are simple:

- using once the just one or a few joint people

- an enthusiastic Australian citizen(s) or long lasting resident(s)* during the time of going into the financing

- at least 18 years of age

- earning around $125,000 for those otherwise $two hundred,000 to own mutual candidates, as found with the Find regarding Evaluation (awarded of the Australian Taxation Office)

- about to feel owner-occupiers of the purchased possessions

- Very first homebuyers or earlier in the day residents which have not had otherwise had an interest in a bona fide assets in australia (for example getting property just) prior to now ten years.

You may also bump a number of thousand out-of you to definitely initially put if you use one of the first Homeowner Gives, which give cash offers in order to first homebuyers and if our home they truly are to shop for is significantly less than a specific worthy of, along with other conditions.

Play with an effective guarantor

Lenders are usually inclined in order to agree your when you yourself have a guarantor for your mortgage. That’s some body (usually a dad), which believes when planning on taking responsibility getting repaying the home financing if the your neglect to make the payments and usually supply its individual assets due to the fact a safety on the mortgage.

This may expose a level of chance toward guarantor, because they you are going to lose their residence when you look at the a terrible-circumstances situation, but when you provides a willing guarantor online, this tactic will probably be worth taking a look at. Using a guarantor may suggest you’re able to skate up to the usual deposit standards, such as demanding a beneficial 20% deposit to avoid the brand new feared Loan providers Home loan Insurance rates (LMI).

Look for properties in your mode

Probably it is important can be done when buying a domestic anytime, not only while the students, is going http://paydayloancolorado.net/sunshine/ to be reasonable rather than buy external their form. This simply means you need to perhaps reconsider to acquire an high priced possessions near the town – you aren’t attending have a massive income because the a student, therefore, the bank is much more planning to approve you having a beneficial less home with far more down money.

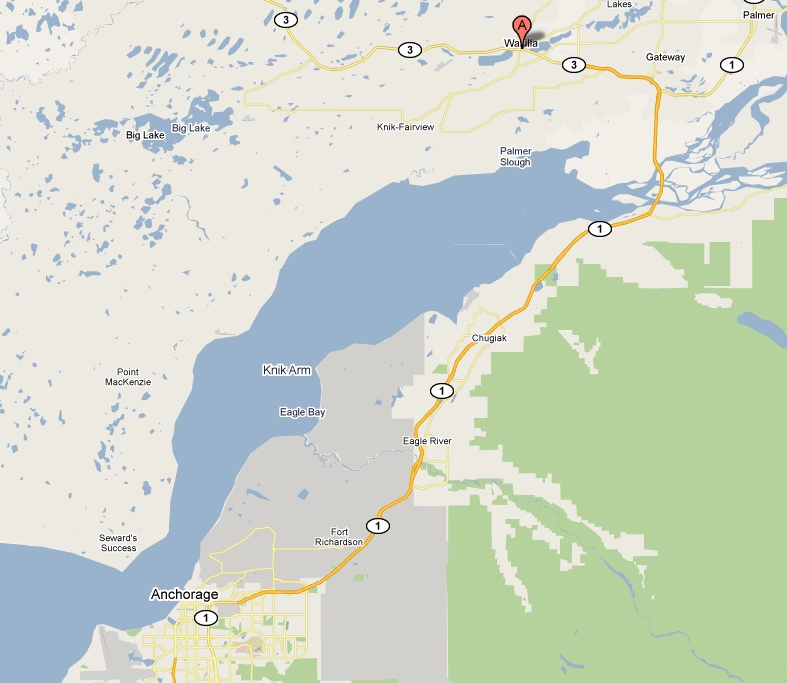

Given that during the , new federal average house speed for the investment metropolitan areas is actually $878,414 centered on CoreLogic, during local section it’s $627,872bined, Australia’s national median hold price is $793,883.

Obviously, such numbers usually disagree according to whereabouts in australia you are looking to purchase, however, in most cases it’s pretty high priced every where. An effective 20% put on that national average might possibly be $158,776. Brand new month-to-month repayments to the financing toward remaining 80% ($635,066) – incase a good 6.20% p.an effective. dominant and you can attract home loan more than a thirty year loan title – would be $3,890.