The facts are the same as in the example under Figuring Depreciation for a GAA, earlier. In February 2024, Make & Sell sells the machine that cost $8,200 to an unrelated person for $9,000. You treat property under the mid-quarter convention as placed in service or disposed of on the midpoint of the quarter of the tax year in which it is placed in service or disposed of.

New Capital Gains Tax Rates for 2025 Are Now Available

For listed property, you must keep records for as long as any recapture can still occur. The passenger automobile limits generally do not apply to passenger automobiles leased or held for leasing by anyone regularly engaged in the business of leasing passenger automobiles. For information on when you are considered regularly engaged in the business of leasing listed property, including passenger automobiles, see Exception for leased property, earlier, under What Is the Business-Use Requirement. For passenger automobiles and other means of transportation, allocate the property’s use on the basis of mileage. The determination of this August 1 date is explained in the example illustrating the half-year convention under Using the Applicable Convention in a Short Tax Year, earlier. Tara is allowed 5 months of depreciation for the short tax year that consists of 10 months.

Start With the Straight-Line Method

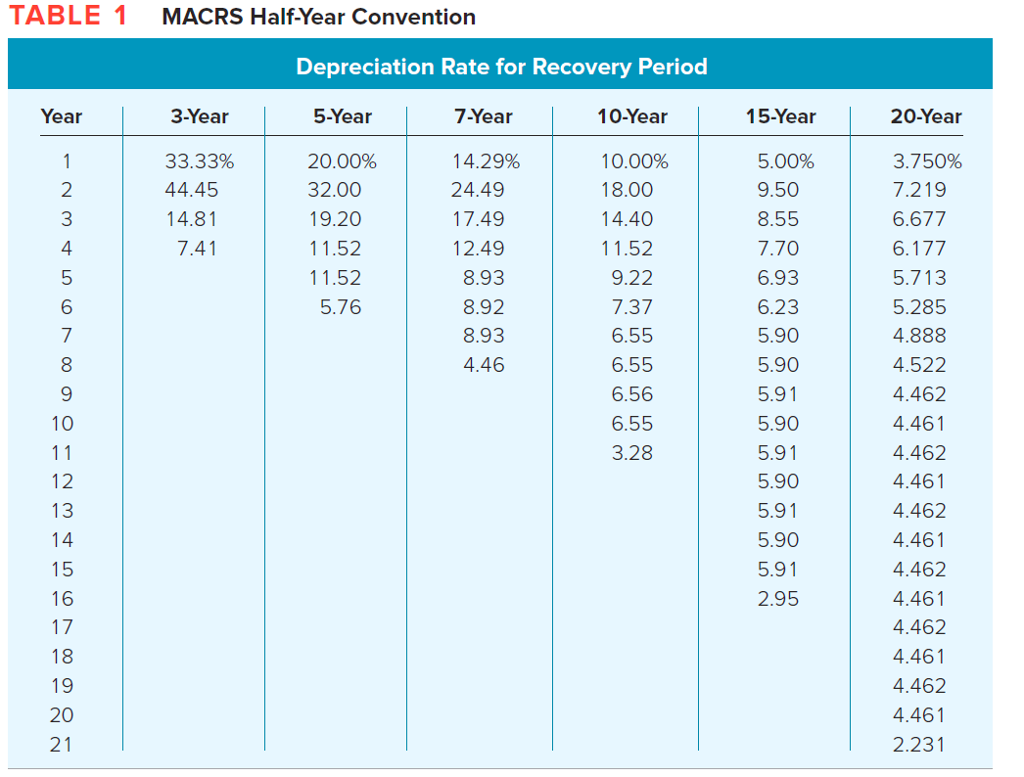

Alternatively, you can use the tax tables in IRS Publication 946 to determine your convention and depreciation rates. Very simply, the general MACRS depreciation formula is an accounting formula that allows for a larger tax deduction in the early years of an asset’s useful life and less as time goes by. This is in contrast to straight-line depreciation, which allows you to claim the same deduction year after year. As noted, determining the recovery period under the ADS is a bit different.

MACRS Depreciation Systems

In other words, unlike other depreciation methods, the salvage value is ignored completely when the company calculates the declining balance depreciation. For example, on Jan 01, the company ABC buys a machine that costs $20,000. The company ABC has the policy to depreciate the machine type of fixed asset using the declining balance depreciation with the rate of 40% per year. The machine is expected to have a $1,000 salvage value at the end of its useful life.

Keep in mind, GSD uses the declining-balance method to depreciate assets. My depreciation calculator includes both MACRS depreciation calculations and straight-line book depreciation calculations. Additionally, I included a row capturing the temporary timing differences between MACRS and book depreciation, which will eventually reverse as time passes. Based on all this information, you determine that Table A-1 (below) is the proper MACRS depreciation table to use for the office furniture.

Table A-15: 150% Declining Balance Method; Mid-Quarter Convention; Property Placed in Service in First Quarter

Where DBD is the declining-balance depreciation expense for the period, A is the accelerator, C is the cost and AD is the accumulated depreciation. To include as income on your return an amount allowed or allowable as a deduction in a prior year. A method established under the Modified Accelerated Cost Recovery System (MACRS) to determine the portion of the year to depreciate property both in the year the property is placed in service and in the year of disposition. The original cost of property, plus certain additions and improvements, minus certain deductions such as depreciation allowed or allowable and casualty losses. You can prepare the tax return yourself, see if you qualify for free tax preparation, or hire a tax professional to prepare your return. Although you must generally prepare an adequate written record, you can prepare a record of the business use of listed property in a computer memory device that uses a logging program.

- The S corporation allocates its deduction to the shareholders who then take their section 179 deduction subject to the limits.

- Hence, the declining balance depreciation is suitable for the fixed assets that provide bigger benefits in the early year.

- However, you do reduce your original basis by other amounts, including the following.

- For a discussion of when property is placed in service, see When Does Depreciation Begin and End, earlier.

- Your depreciation deduction for the second year is $1,900 ($4,750 × 0.40).

Ready and available for a specific use whether in a trade or business, the production of income, a tax-exempt activity, or a personal activity. A ratable deduction for the cost of intangible property over its useful life. Generally, for the section 179 deduction, a taxpayer is considered to conduct a trade or business actively if they meaningfully participate in the management or operations of the trade or business. A mere passive investor in a trade 150 declining balance depreciation or business does not actively conduct the trade or business. If the property is not listed in Table B-1, check Table B-2 to find the activity in which the property is being used and use the recovery period shown in the appropriate column following the description. The safest and easiest way to receive a tax refund is to e-file and choose direct deposit, which securely and electronically transfers your refund directly into your financial account.

Ellen includes $4,018 excess depreciation in her gross income for 2023. To figure your MACRS depreciation deduction for the short tax year, you must first determine the depreciation for a full tax year. You do this by multiplying your basis in the property by the applicable depreciation rate. Do this by multiplying the depreciation for a full tax year by a fraction.