Student loan Cash out Refinance

Education loan Cash out Re-finance, Allow your domestic pay-off your own figuratively speaking. The money you really need to graduate on the pupil personal debt are proper inside of your entry way with most useful cost than simply a great traditional bucks-away re-finance! Everbody knows one to refinancing your home loan may help websites you a lower financial interest, but what you do not discover could it be may rating your dollars to settle the bill of your student loans. PRMI’s Student loan Cash out Refinance can stop the student loan costs and also have you ideal words for the mortgage payments, all-in-one effortless exchange. Begin now because of the getting in touch with the John Thomas Class in the 302-703-0727 or Pertain On the internet.

The application can be obtained having a fannie mae Old-fashioned Mortgage towards your primary quarters. To help you meet the requirements you should meet with the after the recommendations:

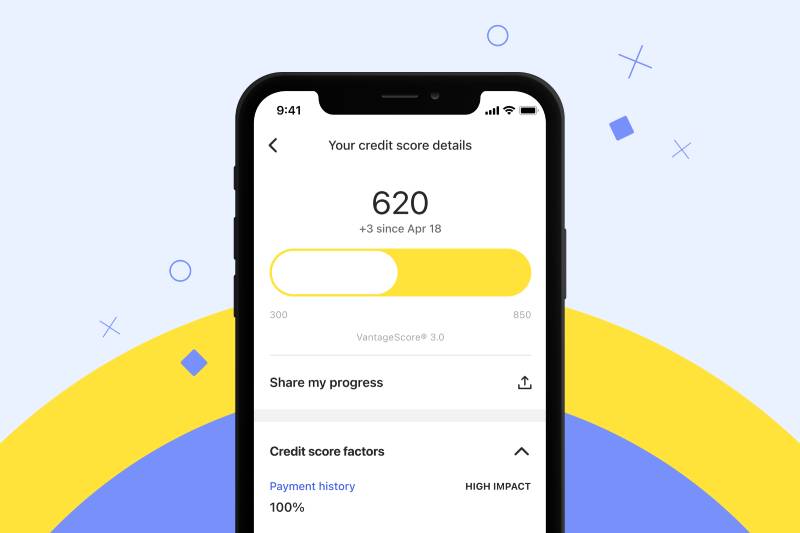

- Have to have minimum 620 Credit history

- Top Quarters Re-finance Only

- Restriction Mortgage so you’re able to Worthy of try 80% LTV

- Need possessed your home for around one year

- Must pay out of a minumum of one student loan in full

- Max cash so you can debtor on closing is actually $2,000 otherwise 2% of the loan equilibrium, any kind of was faster

- You should never Pay every other personal debt

- Limited which have a federal national mortgage association Conventional Loan

Of the fulfilling this type of requirements, you could make use of a more affordable way to combine the figuratively speaking together with your mortgage, potentially saving many over the life of your loan.

What are the Great things about the brand new Federal national mortgage association Education loan Bucks-Out Re-finance?

Merging college loans or other bills with your mortgage isn’t really a good the brand new style-individuals have become carrying it out for a long time. What exactly is altered, although, ‘s the cost of this when you want to pay out-of student loan debt.

Previously, debt consolidating compliment of a finances-aside refinance tend to was included with highest rates through just what are entitled mortgage peak rates customizations (LLPAs). not, Fannie mae has introduced a choice that could notably reduce your can cost you if you utilize a cash-away re-finance particularly to repay student loan debt. This 1 enables you to access prices much like those considering to your zero-cash-aside refinances.

Example Education loan Cash out Re-finance

Contained in this example, the fresh borrower manage be considered just like the Mortgage so you’re able to Value (LTV) was lower than 80% when consolidating current financial, loans in Oneonta closing costs plus the education loan.

Yet not, if for example the consumer’s student loan is actually $50,000 rather then the re-finance won’t functions just like the brand new mortgage amount do go beyond the fresh limitation of 80% limit LTV.

In case your client got a couple student loans at the $twenty-five,000 per to possess all in all, $50,000 then the refinance you certainly will continue to work with just repaying one of the figuratively speaking having $twenty-five,000.

Contrasting Standard Dollars-Out and you can Education loan Dollars-Away Refinances: Just how much Might you Save your self?

Fannie Mae’s assistance were risk-established fees also known as Loan Top Speed Alterations (LLPAs). These types of fees are generally high having important cash-away refinances, leading lenders to boost interest rates to cover can cost you.

However, if you are using the latest unique Fannie mae bucks-out refinance to pay off college loans, brand new charges try much more all the way down. Instance, when you yourself have a good 700 credit score and you can an enthusiastic 80% loan-to-well worth proportion, you might rescue up to $1,375 for every $100,000 borrowed compared to a basic bucks-aside re-finance. Which huge difference you are going to lower your rate of interest by up to 0.5% to at least one%.

New coupons are so much more high to possess borrowers which have lower credit score. For those who have a credit history out of 660, you could potentially conserve in order to $dos,250 for each and every $100,000 borrowed, resulting in an increase which is 1% to a single.5% below an elementary cash-away re-finance.

Just how can Your Get the new Education loan Re-finance?

When you’re trying to find learning more details or to apply for this Fannie mae Education loan Cash-out Re-finance up coming provide the John Thomas Class with First Domestic Financial a call on 302-703-0727 or Incorporate Online.