Say youre a citizen who is not planning to touch your own 3% first-mortgage rates, nevertheless you would like currency to have X.

What is the difference in a fixed-rates second home loan, also called domestic guarantee financing or HELOAN, and you will property collateral credit line, otherwise HELOC?

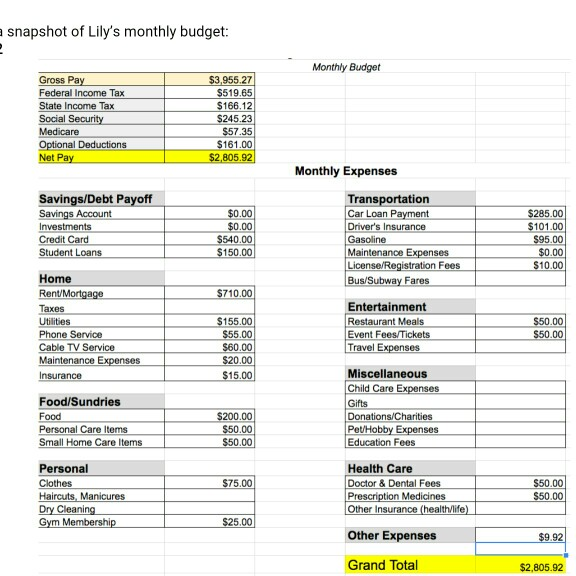

In the two cases, new lien is during second condition about an initial financial. (We will prompt clients you to definitely Ca phone calls the original financial a deed off faith.)

A resident generally speaking taps security to obtain dollars. Guarantee ‘s the property value without any first mortgage. Generally, a borrower can go to 90% mutual financing-to-worthy of. Like, our home is really worth $1 million. The very first is $600,000. The borrower could take aside around $3 hundred,000 towards the the next lien. It will be the total of your funds ($900,000) split up of the value of ($1 million).

That have a fixed-rate second mortgage, and in most cases although not all the situation, individuals are provided every currency upfront in a single lump sum. The loan notice and you can commission is fixed into life of the loan. Financial rates to possess really-accredited borrowers is just as reasonable given that six.65% so that as higher since (roughly) 10% for poor borrowing individuals.

HELOCs mimic just how handmade cards really works. You could use and you will repay, at least into first a decade. You can also repay desire-merely otherwise dominant and you may demand for the individuals first ten years.

Immediately after ten years, for the kept state fifteen years, you need to amortize and pay off the balance from the remaining day remaining. Which means expenses dominating and you can notice. The HELOC try frozen immediately after a decade, so that you can not tap a great deal more equity from it. HELOCs are generally tied to the top rate, that’s currently on have a glimpse at the hyperlink 8.5%.

Towards Sept. 18, the fresh Government Reserve is probable gonna mention a-one-quarter-section lack of quick-label rates of interest, not the brand new 50 % of-area most of the domestic equity borrower, prepared having bated inhale to the sidelines, was hoping for. Meaning the top speed tend to shed to eight.25%.

Just what sealed the offer is the user Speed Index declaration Sept. eleven one presented center inflation price (associated with houses) rose abruptly few days over day of 0.2% to help you 0.3%.

It may be prime plus zero getting better-licensed borrowers, meaning your price create accrue during the 8.25%. It can be primary and several, definition the rates might possibly be % for weaker individuals.

Fundamentally, for people who curently have expenses to repay, or perhaps you is tapping security to shop for a different sort of assets, I would suggest the new repaired-speed 2nd home loan. Fixed prices for many borrowers are much cheaper than variable prices. And also you don’t have to care about a potential rate boost.

HELOCs you are going to top suffice a borrower who does not require hardly any money upfront, or if they merely need some currency initial yet not all from it. HELOCs are also an effective of course, if regarding crisis credit line.

There are even adore, unique second mortgages. This means you can implement using bank statements to possess earnings when you look at the lieu off tax statements having worry about-functioning borrowers. You could set either on a rental property. One system goes up to help you an excellent $1 million amount borrowed.

With respect to the size of your first home loan plus most recent rate of interest, also what you need into the one minute, it might behoove you to get another first-mortgage alternatively.

Instance, what if you just are obligated to pay $150,000 in your first mortgage at a great 3.25% interest. Nevertheless need pull $400,000 inside equity away from home. State, the rate toward 2nd is actually eight.75% into a beneficial 20-12 months fixed. But you can redo the whole $550,000 to the a different sort of first in the 5.99%. Rate of interest-smart and maybe cashflow-smart, it might seem sensible so you’re able to upgrade the original.

Costco house security financing

Facts and you will fees are priced between as little as no-rates in order to dos issues or 2% of loan amount together with settlement fees. Such as for instance, 2% out of $100,000 try $2,000. Plus, you may possibly have identity insurance rates, assessment, payment agent and you may tape charges that’ll focus on $dos,000 or quicker.

By using the new cashout to repay a cards cards, an auto loan and say a student-based loan such as for instance, no income tax deductions to you personally. If you’d like to eliminate money off to create an accessories dwelling tool, then it’s deductible that have deductibility constraints.

It’s always good to go more than any proposals together with your taxation adviser and/or your financial planner ahead of entertaining together with your home mortgage founder.

Freddie Mac computer rate news

The newest 31-seasons fixed rate averaged 6.2%, fifteen foundation points lower than a week ago. The fresh new 15-12 months fixed rates averaged 5.27%, 20 base circumstances less than last week.

Summation: Incase a borrower gets the average 30-seasons fixed speed for the a compliant $766,550 financing, last year’s payment was $423 more that it week’s fee from $4,770.

The thing i discover: In your community, well-accredited individuals could possibly get the second repaired-price mortgages that have some point: A thirty-seasons FHA from the 4.875%, a fifteen-year old-fashioned at cuatro.625%, a thirty-year conventional at 5.375%, a good fifteen-season conventional high equilibrium at 5.125% ($766,551 to help you $step one,149,825 into the La and you may OC and you may $766,551 so you’re able to $step 1,006,250 during the San diego), a 30-year-high equilibrium antique during the 5.625% and you will a beneficial jumbo 30-season repaired at the 5.99%.

Note: The fresh 31-season FHA conforming financing is limited to help you financing regarding $644,000 on Inland Empire and you may $766,550 when you look at the La, Hillcrest, and you may Lime areas.