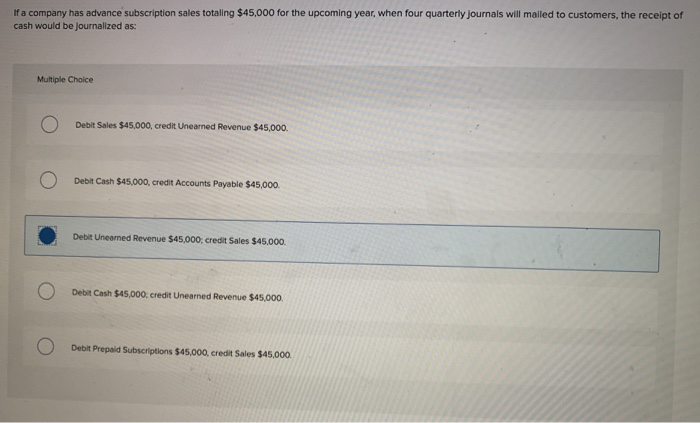

Are you currently curious about how financial institutions disburse domestic build loan amount versus basic home loans? Are you aware that there will be something titled Pre-EMI’? Do you know the requirements having property design loan?

Building a bespoke home which have Build Loan

Self-building at your house in place of to shop for good pre-developed residence is an effective selection for anyone who has supply to the right spot and primary venue. If you’re fun and you can adventurous, design a property from scrape was a demanding procedure that means numerous big date, effort and money. To ease this action, of many financial and you will loan providers give financial advice on the form out of domestic structure loans.

You can test making an application for a home construction loan, for those who have a parcel, where you could possibly make a home for yourself, make a house so it can have to your book otherwise sell it having a revenue.

Family Construction Loan Conditions

Might qualification standards , and you will paperwork number is actually just like various other financial. A debtor must fill in evidence of money, title, and you may a position, which will let the bank to evaluate the latest borrower’s financing fees potential.

In the event of design financing, lenders keeps a rigid control of application of credit and vigilantly display screen brand new borrower’s possessions records and you will enterprise rates. Financial institutions and economic schools try tight which have underwriting and you will documentation whenever you are considering sanctioning borrowing getting care about-framework off a house.

Here are the two tactics you to lenders have to pay attention to before applying having a property home loan:

- Get your property data ready Because the possessions ordered will act as a security which will be mortgaged on the lender till the mortgage are paid back, loan providers carefully scrutinize the property data files. Transformation deed, courtroom status of your own spot, recognized bundle and you can NOC on the municipal regulators are several data you to definitely a borrower will have to submit.

- Get framework preparations able Entry an excellent tentative design package that is at the mercy of changes manage end up in application for the loan rejection. Financial payday loan Pleasant Valley institutions inquire about a detailed build plan during the mortgage recognition procedure. The plan need certainly to clearly include facts such as floor agreements, borders, reason for the property, worth of the house or property, service providers, inventory, total cost, period of time, and you will estimated earnings (in case there are selling/rent).

What to Think about Regarding the Family Design Loan

Owing to the newest built-in character on the home loan device, this new recognition and you may disbursement techniques try slightly unlike additional lenders. Due to the fact of your own large standard risk in the it. The danger grounds is large to own a different but really-to-become created home when comparing to pre-created otherwise around-framework opportunity of a specialist builder.

- Loan amount disbursement Credit out-of a prescription mortgage are paid due to the fact initial downpayment is established. Loan providers request an advance payment quantity of 20% of the build rates/property value just before disbursing the loan matter. That it commission you’ll change from lender to financial. In the case of typical (for pre-built otherwise significantly less than design features) mortgage, the financing was paid at the one go-by the financial institution. In happening out-of framework mortgage, this new accepted matter is definitely released during the instalments. The fresh new progress from design, size of the borrowed funds and mortgage in order to really worth proportion (LTV) determines this new instalment size.

- Slow progress manage apply to disbursement Loan providers normally have pre-decided amounts of framework improvements to own mortgage disbursement. The most common milestones is actually base top, lintel level, tangible work and therefore the final height. The speed of construction has a direct effect to the loan amount disbursement. The financial institution gets the authority to prevent brand new money, in the event your framework pastime are put off or holding.

- Borrower can not replace the framework package Financing people will question if they can take a housing mortgage away from a lender to construct several flooring after which construct simply one or vice versa. The simple answer is, no! Lenders features a team positioned to store a constant view to your design improvements. Any departure on the actual plan submitted within the app processes, be it extension or cures, you will push the financial institution to frost the borrowed funds and avoid disbursement.

- Cost of interiors is not included in the mortgage Design loan merely talks about the cost of permanent features of strengthening a home. Therefore, any expenditures obtain if you’re installing brand new interiors, seats, plumbing, bulbs or other like issue, would have to be repaid by debtor. No matter if, there are more financial products like Individual Financial otherwise Home improvement/Restoration which could come in handy to own funding the inside work costs of your fantasy home.

- Pre-EMI Appeal Commission Build financial apps have to spend Pre-EMI in the framework time of the assets. Which amount is the appropriate interest toward loan amount paid and you can excludes the actual EMI matter and you may loan tenure. Because the house is built and you will finally amount borrowed is released, the real mortgage tenure begins.

Explore The options

In India, ICICI, HDFC, Bajaj Finserv, Aadhar and PNB Casing are a few of many finance companies and loan providers offering family structure money. Each one of the lenders provides lay more loan amount constraints, that is heavily dependent on the value of the house or property and you may installment skill.

Such as, Aadhar Property Money offers loan around Rs. 1 crore, maybe not exceeding 70% of patch rates or 80% away from build costs. Pradhan Mantri Awas YoAY) with 6.50% attention subsidy is a wonderful plan for all of us interested in reasonable property loan choice.

With thorough considered and an effective builder, a borrower increases the chances of his/her software bringing approved which have beneficial words. Research commonly online and ask around to have advice before carefully deciding with the the past device. If you like one advice for the knowledge domestic design loan options, bringing put to help you greatest loan providers otherwise doing a getting rejected facts app, i suggest that you reach out to a home loan coach/professional.