Industrial money suffice of numerous functionspanies employ them to expand their place, tap the brand new ent otherwise a home, lower debt, loans operating capitol, and work out acquisitions.

In terms of industrial business loans, there’s absolutely no you to-size-fits-the. That’s why a personalized approach to commercial financing was imperative. There’s a change amongst the need away from an emerging start-up trying debt funding rather than an experienced team purchasing an alternate team.

Prior to beginning the economical team financing procedure, some elementary research required. Research the various types of loans available, in order to figure out which you’re most appropriate for the company.

Traditional Title Loan

For most small enterprises, a vintage identity loan fulfills the balance. The main benefit of this loan is you provides a fixed monthly payment toward certain title of your own mortgage. Name loans can be used to funds the purchase regarding gadgets.

Business Management Fund (SBA Money)

Small company Administration (SBA) finance try an alternative choice. Not only can a keen SBA loan give most readily useful terminology than many other commercial finance, but it’s partially secured by federal government. Such money are not made directly because of the SBA but are offered by SBA-secured loan providers. Because of this limited make sure, the lending company is more protected and will give larger bonuses, such all the way down interest levels and you may expanded conditions. The brand new SBA financing techniques, however, is quite challenging.

Home Loans

To buy assets for your business requires acquiring a commercial home financing. Down money towards the commercial home fund was larger than those people getting land that will include 15 so you’re able to 35 per cent of one’s purchase price. Cost terms are shorter, basically starting anywhere between five and you can twenty years. Rather than extremely domestic real estate fund, discover fundamentally prepayment charges in place in the event that make payment on loan from very early.

Providers Credit line

A corporate line of credit allows you to borrow to a specific amount, however, pay desire simply to your number you are indeed having fun with. Such as for example, in the event the company personal line of credit is $100,000, you are just playing with $fifty,000, that’s the amount on which desire is recharged. A business credit line is one of versatile products off financing that will be have a tendency to regularly assistance increases as well Marble loans as for standard working-capital need.

Industrial Mortgage Considerations

Before taking out a commercial team mortgage, you should envision very carefully why your company tries which resource. Here is what banks label “identifying the new borrowing from the bank result in”. (Just what was the cause of need acquire? How long have a tendency to the mortgage be needed?) Financing merely to remain afloat isnt feasible unless you can prove that providers will grow notably soon. The commercial lender is just about to want an accurate answer whenever inquiring the reason why you wanted a loan, while need certainly to present they into the straightforward conditions.

The common things about taking right out a commercial mortgage become doing a business, growing they and managing typical costs. There’s nothing wrong which have taking right out financing to keep up a defensive support, but no matter what factor in the mortgage, total data is required.

Guarantee

A security mortgage, known as a guaranteed financing, can be used to protect lenders in case you default in your payments. Security normally classify because the something that you own, like attributes, car if not discounts.

If you are industrial loan providers none of them security for each and every loans, they must protect their interests and you will guarantee is normal. What that it equity includes hinges on the individual business. If you are a house is among the most frequently employed brand of equity, other assets belonging to the organization may also prove acceptable.

If the organization has no background otherwise credit score so you can discuss about it, that will not suggest they will not receive a professional real estate loan. But not, the owners might have to make sure the loan and their personal assets. Should the residents default towards mortgage, the economical bank are able to get well the funds from them. There aren’t any programs analogous compared to that out of FHA or Virtual assistant finance inside domestic mortgages getting commercial loan providers. Addititionally there is no like material given that personal mortgage insurance coverage, so lenders confidence the house or property while the security in the event the a standard happen.

Commercial Financing Pricing

In terms of commercial financial lending prices, anticipate them to prove between 1 and dos.5 % higher than domestic mortgage pricing. Needless to say, you would like an informed commercial credit rates offered. Far relies on your credit history, the kind of team, the amount of collateral and you will loan have.

Commercial Mortgage Info

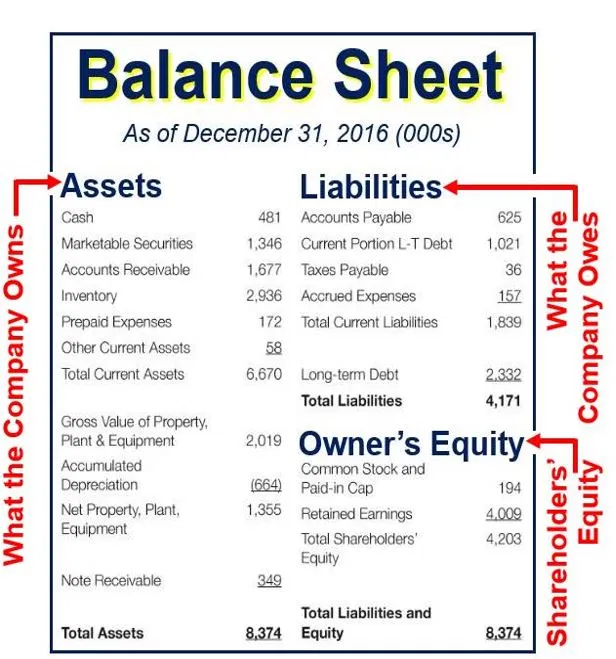

Whenever completing the program, reliability, and you can paperwork is important. Inaccurate data is the best station getting mortgage denial. Become the associated financial recommendations, and feature proof financing repayment ability. The second start from your earnings forecasts, cash flow, tax statements, and you will financial comments. A good, detail by detail business strategy is a complete criteria. It goes without saying that you ought to possess good credit and you may tabs on purchasing debt on time.

Should your documentation seems messy, hire an enthusiastic accountant ahead to go over they and ensure everything you is within set before you fill in the mortgage app.

Dont submit an application for one or more industrial loan during the a good day. That is because the financial institution checks your credit rating, as well as the examining by itself could potentially cause the fresh rating to drop a good pair facts. Apply for several fund in the series additionally the certain lenders examining their rating might end up dropping it notably. Apply for the borrowed funds you can see one most useful suits your needs and that you are most likely for.

How Colorado Safety Financial Might help

Within Colorado Safety Bank, i pride ourselves with the offering the best commercial loans for our customer’s means. We offer loan independency in accordance with the individual organization. A regular organization requires different choices than simply you to with steady cashflow. We modify finance for every buyer, once delving into business’ operations and you can requirements. If your providers seeks financial support for new products, brand new assets, working-capital or any other types of expansion, Colorado Defense Bank is here now to you personally. Call us today and you may plan a scheduled appointment.

Together with providing commercial funds, Colorado Coverage Bank as well as aims to provide worthy of with the independent advertisers giving government training and business owner studies compliment of new TSB Academy and you will TSB Audio speaker Show within its objective out of Elevating the fresh new Champions out of Free enterprise. We all know you to definitely toward business owner, studies is fuel. Look at the Team Training section of our site to get more info.