Simply put, an appeal-just financial happens when you only pay desire the first numerous many years of the loan – and come up with your own monthly premiums straight down when you begin making financial costs. Regardless of if this may seem like a captivating opportunity to save your self on your own home loan repayments, prior to exploring notice-merely financing alternatives, learning how they work is key.

An important thing to keep in mind about attention-only mortgage loans try: Given that attention-just months ends, you start purchasing both the focus and you may dominating. You have the accessibility to and then make dominant costs through your interest-merely commission title, but when the eye-merely months closes, each other interest and you may prominent repayments are needed. Just remember that , the time you have getting paying the main are smaller than your current financing name.

How a destination-only really works

Most notice-only finance try prepared due to the fact a varying-price financial (ARM) additionally the capacity to generate notice-merely costs will last as much as 10 years. After this introductory months, you can begin to pay each other dominating and you can desire. It is paid off in a choice of a lump sum or perhaps in subsequent repayments. The interest rate towards an arm Loan increases otherwise decrease about duration of the loan, when their price adjusts, your payment will change as well.

Particularly, by using aside an excellent $a hundred,000 desire-merely Sleeve at the four %, with an intention just age a decade, might need to pay throughout the $417 a month (simply with the attract) to the earliest 10 years. If this focus-simply months comes to an end, your monthly payment matter will improve considerably into the addition out-of both dominant and you will desire payments.

As to the reasons score an appeal-just financial

When you are in search of maintaining your week-to-week construction will set you back reasonable, an interest-merely loan are a beneficial optionmon individuals to possess an interest-just mortgage is actually people that commonly trying to individual property into the long-term – they may be repeated movers or is purchasing the house while the an initial-title financial support.

If you are searching buying one minute domestic, you can believe a destination-just loan. Some individuals pick the second house and eventually turn it on the the number 1 home. To make costs into the precisely the attention can be much easier if you are not forever living in your house yet.

If you find yourself an attraction-merely mortgage may sound tempting for all those seeking remain their money reduced, it may be more challenging to locate accepted that will be generally so much more accessible for those who have tall deals, high credit scores and you may a decreased obligations-to-income proportion.

The huge benefits out of a destination-merely financing

- The initial monthly premiums are down: As you happen to be only to make money towards the notice the initial several years, your own monthly payments are usually down than the different loans.

- May help you manage an excellent pricier household: You might be in a position to obtain a much bigger amount of cash by lower attract-just repayments into the introductory months.

- Will be loans in New Hope paid back smaller than simply a conventional financing: If you are to make more payments with the a destination-simply mortgage, the reduced dominant can be build a lowered fee each month. Regarding a traditional mortgage, additional payments can lessen the main, but the monthly obligations continue to be a comparable.

- You can easily raise on the earnings: Straight down monthly obligations can be leave you with some even more dollars in your finances.

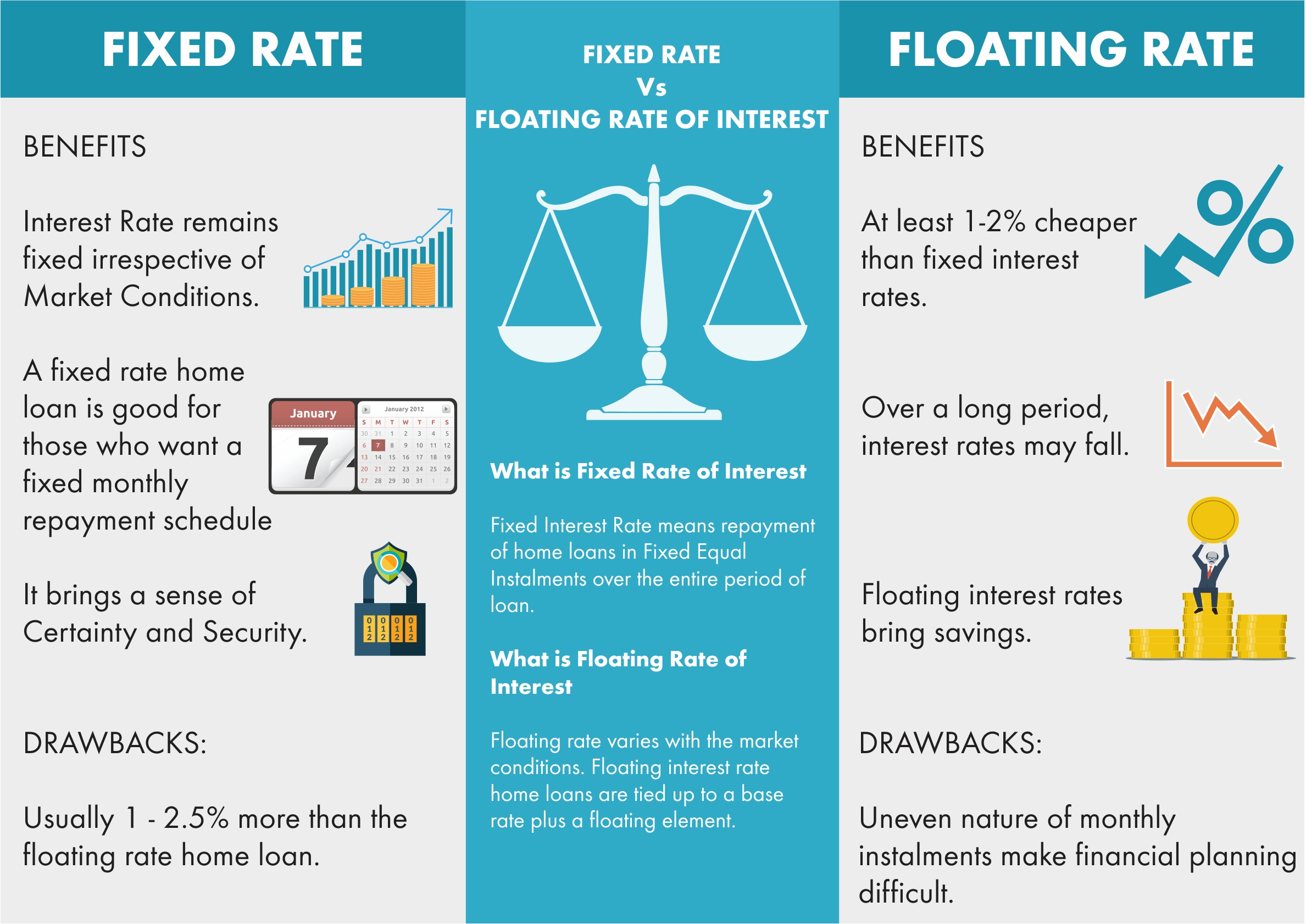

- Pricing may be lower: These financial is oftentimes prepared as the an adjustable-price loan, which could bring about lower prices than a fixed mortgage.

This new drawbacks out-of a destination-only loan

- You’re not building security in the home: Building collateral is very important if you’d like your residence to increase during the well worth. With an interest-just mortgage, you are not strengthening guarantee on the family if you do not start making payments towards the dominating.

- You could treat current equity gathered from the payment: In the event your value of your house refuses, this could cancel out any equity you’d from your own off fee. Shedding security can make it hard to re-finance.

- Reasonable money is actually short-term: Lowest monthly obligations to possess a brief period of time may seem tempting, nonetheless they do not last forever – it does not get rid of the eventuality out of trying to repay your full loan. Because the interest-simply months finishes, your repayments will increase significantly.

- Interest levels can go up: Interest-only loans always incorporate adjustable interest rates. In the event that rates increase, so have a tendency to the level of attention you have to pay in your financial.

You should use an appeal-just home loan calculator to aid falter exacltly what the payments often seem like a couple of many years that have attract-merely, in addition to successive decades when principal costs kick in observe whether it kind of mortgage makes sense for you.

Find out about attract-only financial solutions

An interest-merely financial has its own benefits and drawbacks. If you’re looking to possess lower monthly installments otherwise a primary-name living plan, this can be ideal selection for your. Understand that repayments to your prominent is unavoidable down the latest line. Talk with a house Financing Mentor to see if a destination-simply home loan is right for you.