Condition Discounts Financial also provides multiple loan alternatives for customers who are in need of to build a different sort of family that exist one another online and physically. Our financing benefits direct you regarding whole process and can save you time, money, and you may worry. Our experienced financial advisers will help assist you from the actions of funding everything from start to finish. You can expect many different kinds of structure fund to meet your unique means!

Package Loan

If you’ve decided to purchase much but you’re not in a position to begin with family framework, a great deal mortgage would-be the most suitable choice. Such loan gives you even more independency than just other version of home loans. The loan cost depends on your build day plan.

In the event the framework is decided to start contained in this one year of your lot buy, your payments might be attention-only. If build is decided to begin over 1 year just after the newest romantic of the parcel buy, your instalments might possibly be amortized letting you acquire guarantee just like the your get ready for design.

Construction Mortgage

If you’ve chose to buy much and you are able to begin build immediately, a casing financing is normally all of our necessary option. You pay that loan origination payment, a deposit, or any other appropriate costs. Your loan installment are focus-only in line with the sum of money advanced.

The deductible framework amount borrowed is dependent on the expense of structure together with home’s appraised worth. Home really worth hinges on a certified appraiser in line with the household agreements and you will requirements both you and/otherwise the builder promote. Mortgage enhances on the a houses mortgage can be produced as much as double 1 month.

Permanent Loan

Obtaining a lot of time-name financial money whenever build is carried out ‘s the finally step, transferring regarding a housing in order to a long-term mortgage. While the an enthusiastic origination commission had been built-up in your the brand new build mortgage, we costs no extra origination payment once you obtain long-term capital due to County Discounts Financial. Their structure loan interest will likely be closed within the before the conclusion in your home. Upon achievement off build, a final appraisal identifies the value of their complete household. You can relocate as soon as the town activities an enthusiastic occupancy enable, regardless of whether the permanent financing features closed.

Financing Info

County Coupons Bank offers a multitude of loan options to make it easier to reach finally your requirements. From signature loans in order to domestic design and you may do-it-yourself financing, we you secured! I also provide a range of financial resources of financing hand calculators to help you checking and you will discounts bank accounts, and special income tax-advantaged savings account offered to qualifying First-day homeowners. While the a full-solution Iowa financial, you can trust County Savings Financial with all their financial demands!

Demand Rates

The low domestic construction loan costs was extremely aggressive inside our main Iowa sector town, Polk County, Dallas County, Jasper state, and their nearby counties. Excite get in touch with your state Offers Lender construction loan professional in order to agenda a scheduled appointment or mention framework financing cost and other facts; posting an age-mail so you can otherwise call us within among after the quantity: Baxter: 641-227-3161 otherwise West De l’ensemble des Moines: 515-457-9533.

Home Structure Financing Faqs

Design finance are closed-end personal lines of credit,’ meaning you get better money from the mortgage because you make the house. This isn’t good revolving line of credit eg a credit cards in which you get better from the range, pay they off, immediately after which get better off of the line again. Costs to the framework loan is actually month-to-month focus just, thus early in the mortgage you pay a smaller sized quantity of focus than simply you do at the end after you have more money pulled from the range.

A primary difference between a frequent real estate loan and a homes mortgage ‘s the need for agreements and you may specs of the property you intend to build. Preparations would be the strengthening formula or drawing of the house; specs are the costs description because of its design. Such as for example, just how payday loans Topstone much have a tendency to the foundation rates? It is very important get the preparations and specifications as soon that one can on framework loan process because your financial means provide this informative article to an appraiser to search for the “as-completed” value of our house to-be oriented.

One minute variation is the method the bucks are paid. With a mortgage, funds is disbursed in one go in the event the financial is approved while the resident is preparing to relocate. In the case of a casing financing, the borrowed funds is approved just before construction begins, therefore the cash is disbursed for the phases because design moves on. Attention is only billed towards the amount paid.

County Savings Financial does ensure it is people to behave as their own GC if they has associated framework experience. A resume otherwise evidence of earlier in the day households depending may be needed.

SSB requires invoices from the GC and you may sub-designers per framework draw along with totally done lien waivers into functions in earlier times completed. SSB loan providers also create normal monitors from design in order to confirm the job our company is going forward to own has been completed. This is done to help you include both debtor and you will the financial institution.

Generally speaking, i encourage securing on the interest rate on the end mortgage (fifteen or 29 season repaired rate mortgage) should your house is a month of are 100% over. The maximum rate of interest secure months was two months, so that the last 30 days from build uses up the original half the pace secure period in addition to second half of the speed secure months lets going back to the brand new appraiser and underwriting for taking placemunication between your lender, resident, and you will creator are essential inside phase to prevent paying rate of interest secure extension charges.

Sure. The brand new guarantee you have got about parcel/homes we would like to make your home toward matters to your 20% deposit you’ll need for the building mortgage.

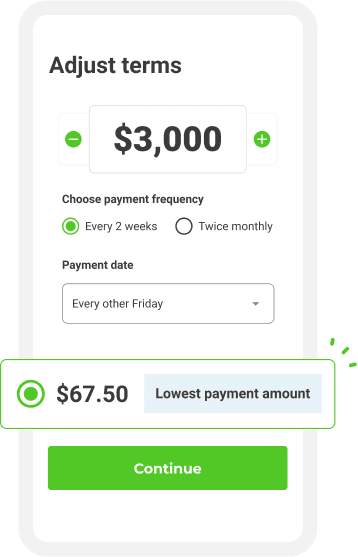

Monthly payments on a construction loan are interest-only based on the amount advanced on the loan. In the beginning, your monthly payments will be less but will steadily increase as construction progresses and more money is drawn off the loan. You can calculate an approximate interest-only payment in the following way: Multiply the dollar amount advanced on the loan by the interest rate expressed as a ount by 12. This is not an official calculation, it will not equal your exact payment and is not legally binding, it is simply a way for you to estimate what your construction loan payments might look like as your home construction progresses.