When you officially shell out attention back again to oneself for the good 401(k) loan, you will be generally losing prospective resource growth. Exactly why are 401(k) arrangements very strong is the riches-building prospective. By firmly taking out that loan unlike letting their investments expand, you diminish their development overall performance.

An educated robo advisors helps you start retirement think travels. Institutions eg Robinhood and you will SoFi purchasing usually promote an enthusiastic IRA fits to greatly help pension deals expand.

Benefits of 401(k) finance

The biggest advantageous asset of providing a great 401(k) loan would be the fact you are able to quickly availableness cash to pay for medical expenses otherwise home repairs. There is no credit assessment, and you may cost laws and regulations was flexible just like the payments is obtained from their paychecks. You might not need to worry about scraping money for mortgage repayments when you are anywhere between paychecks.

Fundamentally, being qualified for a loan relates to a painful borrowing remove, briefly cutting your credit history. Additionally, with a bad credit score could possibly get harm your capability so you’re able to safe the lowest rate or prevent you from getting recognized completely. Thank goodness, 401(k) financing don’t require borrowing checks.

Still, particular bundle providers can also be consider credit ratings and your financial predicament whenever reviewing your loan software, but this is not necessary.

“With a beneficial 401(k) financing you are paying interest to help you oneself in the place of a third-class financial or bank card business,” claims Bethany Riesenberg, SVP from the GeoWealth. “In many cases, the interest rate is gloomier than just bank card costs, that it can make feel to obtain a 401(k) mortgage to settle highest-focus financial obligation you’ve got.”

Drawbacks away from 401(k) financing

The largest downside regarding a 401(k) financing is the fact that money you take from your own 401(k) membership would not develop. Even if you spend the money for cash return contained in this five years, and additionally people attention, this nonetheless may not make up for the cash you shed in the event the business growth taken place within a higher level normally during those people five years.

Fees is actually a different situation, since the credit out of your 401(k) is actually away from totally free. Yes, you’ll be able to spend focus to your self, but that’s nonetheless extra cash you will need to pay. Together with, predicated on the package, you may shell out an enthusiastic origination percentage and you may an upkeep payment to help you sign up for a beneficial 401(k) mortgage.

In case the workplace produces matching efforts, you will miss out on people from inside the age whenever you are not causing their 401(k).

“Specific agreements do not let one still join the 401(k) for those who have a loan the,” claims Riesenberg. “Meaning by using five years to repay the newest financing, it would be five years before you could create financing so you can the 401(k), and you may have skipped deals ventures along with shed from the new income tax benefits associated with and also make 401(k) benefits.”

If you’re unable to satisfy those individuals loans Denver IA conditions, the quantity may be taken from the vested 401(k) equilibrium and addressed such as a shipment (subject to a ten% detachment punishment). The newest broker business managing their 401(k) often declaration they towards the Irs toward Function 1099-Roentgen.

“At that time, it’s handled because the a shipments – which has so much more charge – so it is important to maintain money and stay on song,” says Riesenberg.

Another thing to imagine would be the fact your loan money were created that have just after-income tax dollars (even if you make use of the financing to find a home), and you’ll be taxed again when you withdraw the bucks later on throughout the old-age. Which twice taxation can somewhat processor chip aside at the development.

Procedures to demand that loan from your 401(k)

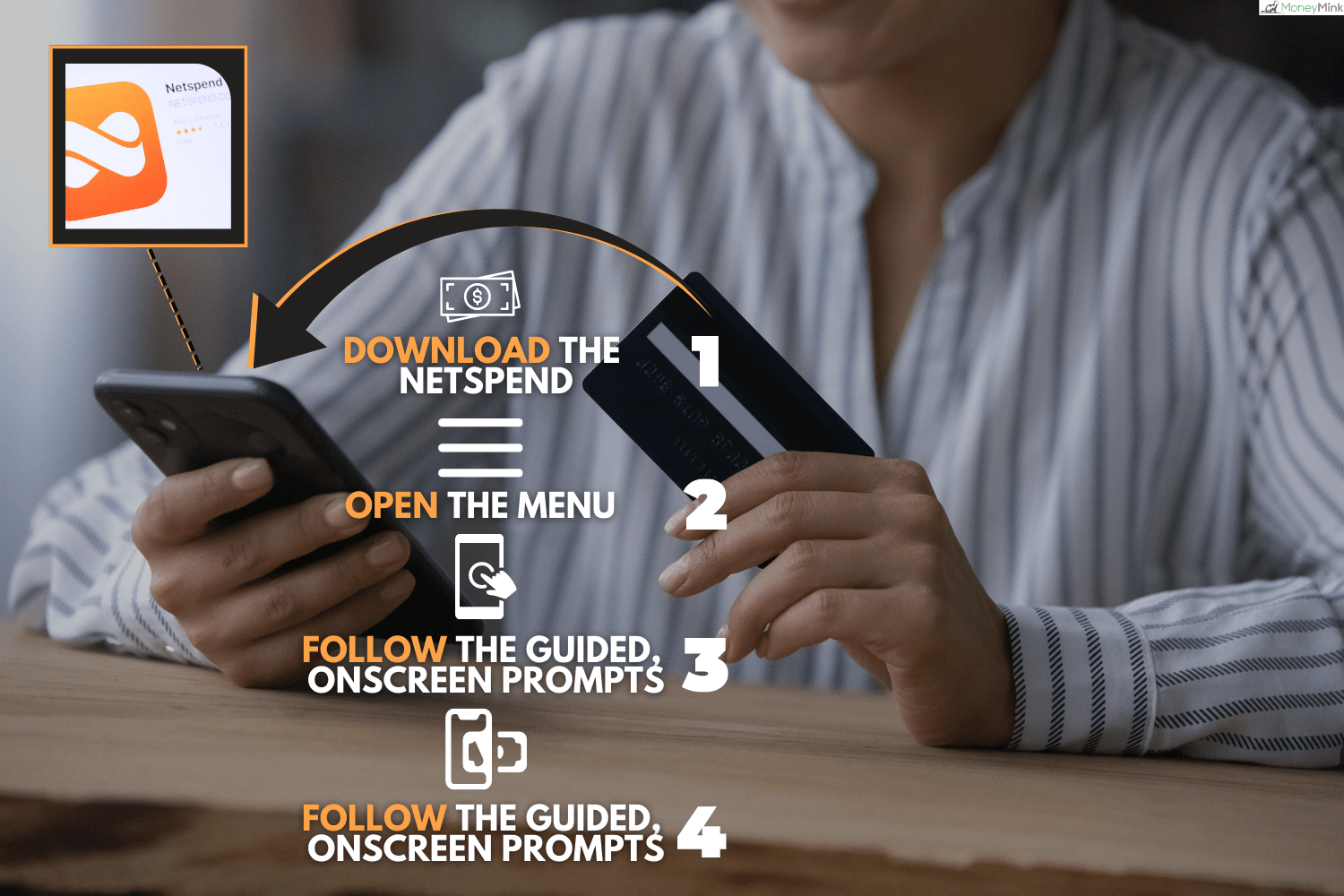

- Contact your 401(k) plan seller: Knowing in the event the 401(k) plan lets fund, you must very first contact your plan provider. Without having the brand new contact information, get hold of your employer’s hr agencies to your proper suggestions. Following that, the bundle merchant can present you with the required versions and words to take out that loan.