Bring your own title, target, contact number, Social Safeguards number, yearly earnings, and houses will cost you inside the a form. You usually located a reply in a matter of seconds.

What to expect

If you get a great 0% Annual percentage rate bank card, perform a decide to pay back the bill through to the avoid of the introductory period. Or even, you are going to need to spend attract.

5. Re-finance your home

If not should place a moment lien on your house or apartment with an excellent HELOC or household guarantee mortgage, you could refinance your home for over your debt and you can do the change. This could be described as a cash-away re-finance. It’s common for some loan providers so you can refinance as much as 85% of home’s really worth. When a loan provider refinances your property, your own old financial was paid, and you’ve got a unique financial.

Very, should your home is really worth $275,100000, you may be capable re-finance $233,750. For folks who are obligated to pay $225,100000, you’d score $8,750 from inside the cash that you might explore on the a crisis family repair.

How-to sign up for domestic refinancing

Since the an effective re-finance was a home loan, could bring most of the information that you will would like to get a home mortgage. Your home could need to be appraised, and you will must offer paperwork regarding your earnings, label, homeownership, property, or any other debt. You can apply to refinance your house from the a bank otherwise go surfing for lenders that offer refinancing possibilities.

What to expect

It takes weeks to do a home refinance. Instance, when i refinanced my personal household, it grabbed on the monthly doing the process. If you prefer currency instantaneously having an emergency domestic resolve, an earnings-out re-finance might not be the best option.

six. Regulators guidance

According to the problem, you are able to get assistance from the government so you can make emergency domestic repairs. There are a couple selection that will offer you money you prefer.

Term I Property Improve Mortgage Program

If you don’t have a lot of security of your house, you happen to be able to find financing all the way to $seven,five-hundred and come up with fixes without needing security. That have equity, you should buy financing as high as $twenty-five,000 and an expression of up to 20 years. Use because of the experiencing a name We lender close by. Phone call 800-767-7468 to find a listing of recognized loan providers towards you.

You can aquire help from the fresh new Government Disaster Administration Administration in the event the your home might have been busted or missing which is located in a place that was announced a tragedy city because of the president. You need to get a grant to cover can cost you which aren’t protected by their insurance policies. To find out if your be considered, fill out an application on line.

7. Financial help out-of family unit members

The ones you love might be able to advice about disaster domestic fixes. When the friends are happy, believe inquiring them to possess financial help. You may want to get the money due to the fact something special, or these include willing to present a decreased- if any-attract loan. For individuals who ily (or family unit members), make certain that you may be sure of traditional. Make a very clear payment package upfront to eliminate destroying your own dating.

8. Make use of your emergency fund

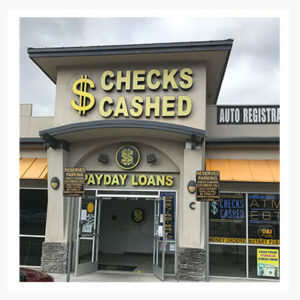

Among the best things you can do is build an crisis funds so that you provides cash readily available in case of an urgent situation family fix. Dipping into your crisis finance can possibly prevent you against entering obligations to possess household repairs or any other will cost you. It is better getting a want to pay yourself back by adding additional money for the crisis financing as soon as your instantaneous need is https://cashadvanceamerica.net/loans/check-cashing-near-me/ addressed.