Many residents might choose to remodel or redesign their houses to raise effectiveness, boost worth of, or modify the look and you can getting of its living spaces. If you’re planning a property restoration, you are probably thinking just how you’ll financing they. Renovations are high priced, and some people commonly don’t have the bucks to cover them downright. The good news is, you will find some solutions which can help you funds your own methods.

Facts house recovery

House renovation should be a complicated techniques, therefore it is best if you understand the principles while having structured beforehand their excursion:

- Define the new scope in your home restoration project. Will you be planning to redesign the kitchen otherwise include another room? Or do you simply want to implement a comparable decorate color on the entire home? Having a very clear idea of what you need to to do have a tendency to help you guess the price of material and service providers your may need to get to get the jobs complete.

- Lay a budget for the repair. Think the cost of labor and content commonly usually feel the most significant expense from a restoration project. Just remember that , work will cost you can vary according to complexity of one’s enterprise and you can possibly the action amount of the builders you are handling. With regards to the scale of one’s repair otherwise renovate, you may have to receive it permits out of your state, so it is important to basis this type of into the budget too.

- Consider carefully your funding alternatives. Because the making home improvements may start out over be a huge debts, you ought to has plans in place to fund purchase any project. This would become place to afford any unexpected can cost you that can become because the procedure has started.

- Look designers and you can suppliers. Come across pros having experience with the sort of recovery you might be seeking to complete and make certain to inquire about getting sources and glance at history before signing people agreements. As well as, compare the expense of product between numerous sources and request prices out of other designers to raised understand what the options is actually.

By the understanding the axioms out of household repair and you may in regards to the strategies you would want to have completed, you’ll be able to help the chances which you can have a softer and you will low-worry sense.

Money your house repair

Regarding resource your residence repair, you’ve got a number of options to explore and determine what would become around. Check out of the very most prominent an easy way to financing the home improvements.

Have fun with deals

When you have discounts arranged, it an effective source of money for your endeavor. By using money you quick $255 loan bad credit currently have on the bank account, you won’t have to pay any interest costs otherwise costs towards the a loan. Before you can pull from the offers, consider making an amount that can help you become open to problems.

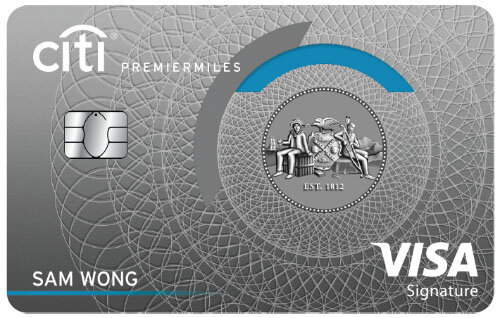

Credit cards

Handmade cards may be a far greater substitute for purchase domestic developments when compared with cash. Many notes has different forms off safety and supply the latest leverage to pay this new due count for the monthly obligations unlike a lump sum. Although not, charge card annual fee cost (APRs) are often higher than almost every other personal lines of credit while ount during the funding charge if you cannot spend the money for cards out of quickly.

Family guarantee loans and you can HELOCs

Property equity loan allows new homeowner to use the benefits of the home as the equity. Once the a property equity financing try backed by guarantee, the average rates are much lower than just credit card APRs and other personal loans. This type of resource usually has a predetermined rate of interest, fixed commission name and you will repaired monthly obligations. And additionally straight down rates, house collateral loans feel the added benefit that attract repayments with the certain renovations may be tax deductible (speak to your income tax advisor to choose for folks who meet the requirements). not, while you are not able to shell out, you might clean out your residence.