It’s shock to find out that getting onto the construction ladder remains indicating become a struggle for some manage-feel earliest-date customers. We’ve got read previously that the Financial of Mum and Father has proven is an excellent source of finance having certain consumers. However, recent profile strongly recommend the individuals looking to buy its earliest possessions is actually seeking stretched home loan attacks, as well.

Data found throughout the Mortgage broker Ltd show that the number of people taking right out good Uk home loan more a great thirty-five-season identity possess twofold in the popularity over the past a decade. In the past, simply eleven% out-of buyers in this classification plumped for a term it much time. Today, this has trebled so you can 33.2% from very first-big date consumers.

The common home loan name is served by improved

A twenty five-seasons financial term was once the high quality amount of home loan really buyers manage choose for. It has now changed as well as the average title is approximately twenty seven years. With several the fresh buyers seeking it difficult discover a fair deal, one to clear choice is to extend the life span of mortgage itself.

New trend is additionally present in the enormous shed about portion of users who have chosen more-common 25-season term. About ten years ago, 59% out of consumers selected that financial name, while in 2010 have viewed this contour drop in order to 21%.

A lot more in check monthly obligations

Many people comprehend the thirty-five-season home loan several months since an easily accessible means to fix eradicate its monthly obligations, told you Darren Pescod, President of the Large financial company Restricted. Sometimes, it could make difference in to be able to conveniently pay for make payment on mortgage otherwise looking for it difficult and work out those individuals costs.

With quite a few demands facing teenagers trying to get onto the casing hierarchy, it’s easy to see why the majority are inclined to like a longer commission name. Although not, it does https://paydayloancolorado.net/catherine/ mean certain are paying its mortgage for the retirement, based after they remove it.

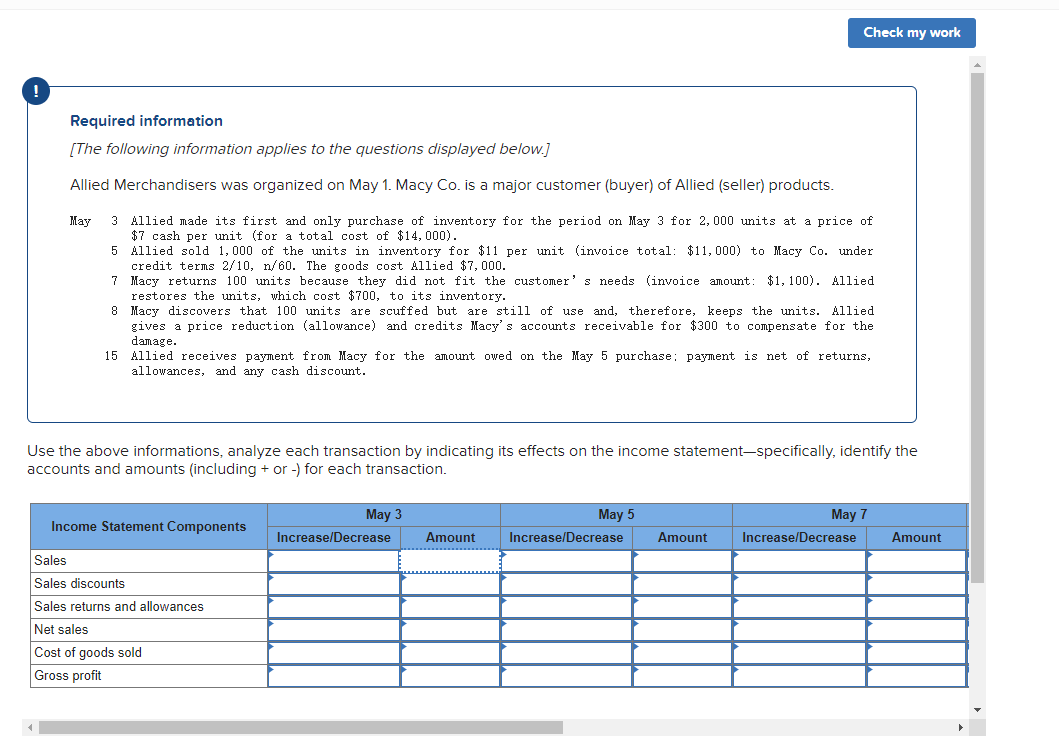

The fresh chart less than suggests the fresh month-to-month pricing considering an effective ?two hundred,000 cost financial with a believed interest away from dos.5%.

As you can see on more than, the difference in expense out of a 25-year mortgage term at the ?897 a month versus thirty-five-year home loan name during the ?715 monthly was a distinction out-of ?182 per month.

The difference between a home loan of thirty-five age and another from forty years, although not, is just ?55 four weeks. Its hence we suggest that clients usually make this review and then try to support the smallest home loan name likely that is reasonable for you.Amount to use (?)Label (Years)Desire (%) Calculate

The industries Should be numeric, therefore ?375,000 is 375000? /moPlease Notice: These types of figures are having illistrative aim simply, that will disagree dependent on the indivial activities.

However, a caution regarding full repayment matter

Not just does the fresh new stretched home loan title suggest the conclusion day try pushed after that straight back, in addition function the entire matter repaid is a lot larger. An example expressed a ?150,000 mortgage taken over thirty five ages rather than 25 years would getting ?137 cheaper monthly, provided mortgage loan out-of 2.5%.

However, the overall repayment perform come out by the over ?23,000. For making the family cost management easier for a while, individuals are using so much more along the longterm. Going for home financing and you can making certain that its reasonable is definitely probably going to be a significant monetary choice. These figures tell you just how correct that is.

We can in reality getting watching a different pattern on the offered financial conditions. It is not easy to assume buyers going for faster home loan terminology should your only way they are able to get onto the houses hierarchy to begin with is via a longer home loan title. The fit for the money is additionally prompting many people to look from the easing monthly home loan repayments. Until so it transform, it appears possible that a thirty-five-seasons home mortgage name becomes more prevalent from the upcoming years.