There is a lot to think about when selecting a house and it’s really typical for concerns, especially if this is your first-time. You may be thinking from the some general basic-date family client tips, or the best way to locate down payment guidance or help with your closing costs.

Right here, we shall safety some of the most useful has, mortgage brokers and you may programs to have basic-time homebuyers, so that you understand what choices are offered .

First-day family consumer will cost you can appear daunting. But, fortunately, there are lots of mortgage applications to have assistance with their down payment and you will settlement costs, in addition to charity and you will government-backed programs. Regional and you will federal tax credit decrease the brand new bite, and informative programs could possibly offer let at each and every step.

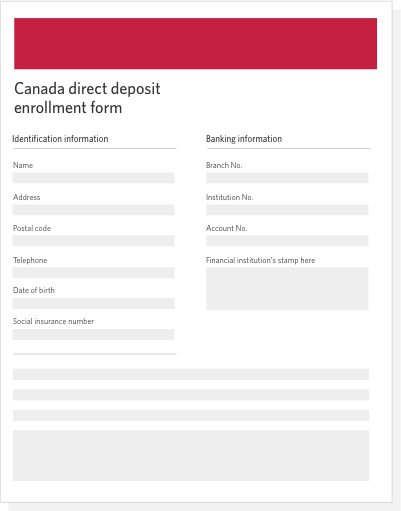

A down-payment is an enormous first expense after you get property, and it is needed for really particular mortgages. Thankfully, of numerous loan providers undertake down-payment guidelines, that will help safety the upfront will cost you out of a lower percentage.

Deposit assistance programs are generally grants or reasonable- to no-interest fund, and lots of is actually exclusive to basic-go out people. This advice software your qualify for can impact the manner in which you are able to use your loans and you will if you will have to pay them right back.

DPA Fund

Unsure you can cover a down payment yourself? You could qualify for down-payment guidelines applications by way of a number of particular particular fund to minimize extent you have to establish.

Loans can be forgiven over a set long time however, will need to be paid down after you flow, promote, refinance or pay off your primary financial for folks who circulate before one to lay long-time ends or otherwise violate the fresh new conditions off forgiveness.

DPA Features

You might be able to find DPA thanks to grants, and therefore don’t have to getting repaid. Program criteria to possess fund and you will grants may vary, it is therefore better to consult your regional otherwise state to have details on one earliest-go out customer downpayment guidance apps.

That loan supported by government entities also may help licensed first-date homebuyers purchase with no downpayment we shall safeguards these fund in more detail less than.

Income tax Write-offs

not, you could nonetheless reduce their fees as a result of various deductions. Federal and state deductions is also decrease your taxable income.

Including, you can deduct the full amount of your financial insurance costs for a primary plus one travel house out of your government taxes if the financial is worth below $750,one hundred thousand ($375,000 when the partnered processing independently). It deduction provides already been prolonged from the 2021 income tax 12 months. This includes private mortgage insurance policies (PMI) and you may financial insurance premiums (MIP) on the FHA financing, plus the make sure charges to possess USDA funds while the financial support commission to possess Virtual assistant financing.

You may also deduct the expense of interest reduced when you look at the seasons into financing wide variety to the aforementioned restrictions for a top and another 2nd household. Speaking of probably the two biggest homeownership deductions.

Closing Assistance

Particularly downpayment advice, you can find authorities-paid and private applications that may help you spend settlement costs. Closing costs was even more charge you have to pay at the conclusion of the borrowed funds techniques. Settlement costs are usually up to dos% 6% of your own total cost of your property loan. Such down-payment guidelines, closure rates assistance may come as a consequence of a grant or loan.

You may want to move to the supplier getting advice about closing can cost you, with seller concessions. The seller may be able to assistance with attorneys costs, a property income tax services and you will title insurance coverage. They’re able to plus let buy facts upfront to lower their interest rate and you will donate to property fees.

You could potentially benefit from on line academic applications and you can resources if you are not sure the direction to go your residence look. Good very first-go out real estate category can be free or lower-priced, and certainly will teach you from the financing solutions, new to shop for process and ways to submit an application for home financing. Lookup home programmes online and find of these intended for first-go out homebuyers installment long term loans no credit check Nashville IN.

Unclear where to start? Zing School is a free online movement from the financial professionals in the Rocket Home loan . Zing College or university guides you from the tips buying a house, shows you on the home loan systems and may also place you in connection with a city representative to cause you to a very confident client.

You can make use of government, county and you will state government applications once you purchase a house. Government applications is open to someone who has got a resident otherwise court resident of your own You.S. Even if not every person qualifies for every single system, it’s not necessary to live in a certain county to acquire federal recommendations. Here are some of the most well-known federal applications for earliest-big date home buyers.

Government-Backed Fund

Government-supported funds can allow you to get a house having a low down payment or poor credit. The us government provides bodies-recognized loans, definition it pose less of a threat to help you a loan provider.

This also means that lenders can offer consumers a reduced focus rate. You will find currently three regulators-recognized loan options: FHA funds, USDA fund and you will Virtual assistant money. For every program has its own a number of certification.

Good neighbor Next door

Are you presently good pre-K twelve professor, crisis medical technician, firefighter or the police officer? You can gain benefit from the Good-neighbor Next door system sponsored by the Institution away from Construction and you may Metropolitan Development (HUD).

The great Neighbor Across the street program offers a large fifty% of see HUD features. The fresh qualities offered try property foreclosure and they are affordable, also without any write off. You can find a listing of offered functions to your HUD program web site.

Fannie mae also offers basic-go out homebuyers the opportunity to buy a great foreclosed assets getting only 3% off with their HomePath system. You may want to get to step three% of settlement costs right back through the program too. Federal national mortgage association homes promote during the since-is actually reputation, so you might need to fix some things just before the the place is actually move-for the in a position. not, closing rates guidelines will help make it a whole lot more you’ll to fund this type of costs.

New HomePath Ready Client system is just open to very first-big date people who wish to live complete-time in property that they are looking to buy. You will need to just take and citation Fannie’s Construction Homeownership course prior to your close.