-High A great- credit rating otherwise without having LTV as strong compensating grounds and you may -An additional risk factor from no less than three of the following:

-Higher uncertainty regarding power to spend otherwise mentioned income’ records particular -highest uncertainty regarding the desire to invest or equity worth” |165|

One method to incur quicker interest exposure try to own WaMu to hang funds with changeable interest rates, eg Hybrid Possession typical off WaMu’s subprime lending, or Alternative Palms, WaMu’s leading “prime” equipment

|166| People property fluctuated when you look at the worthy of according to research by the changes in the fresh rate of interest. Repaired speed fund, in particular, sustained extreme interest chance, while the towards the a thirty-season repaired rates mortgage, eg, WaMu wanted to found attract repayments from the a specific price to own thirty years, however prevalent rate of interest ran right up, WaMu’s price of currency increased therefore the cousin worth of new fixed mortgages into the equilibrium sheet transpired. WaMu used some ways to hedge its interest rate risk. Such adjustable rates mortgage loans reduced rates of interest you to definitely, pursuing the very first repaired rate period expired, have been usually pegged for the Price of Fund Directory (COFI) or the Month-to-month Treasury Average (MTA), a couple preferred strategies of prevailing rates of interest.

So it file demonstrates that WaMu believed a mortgage become large americash loans Crestone chance whether or not it lacked documentation concerning your borrower’s money, referred to as a great “zero earnings” or “said earnings” loan

WaMu’s interior records signify the main determination about their Highest Chance Lending Approach was the newest premium “obtain discounted” earnings produced by high-risk finance. |167| Arizona Shared management got determined that higher risk money were a great deal more effective when ended up selling otherwise securitized. Ahead of income, greater risk money as well as introduced greater short term winnings, as financial generally billed the borrowers a high rate out-of interest and better charges.

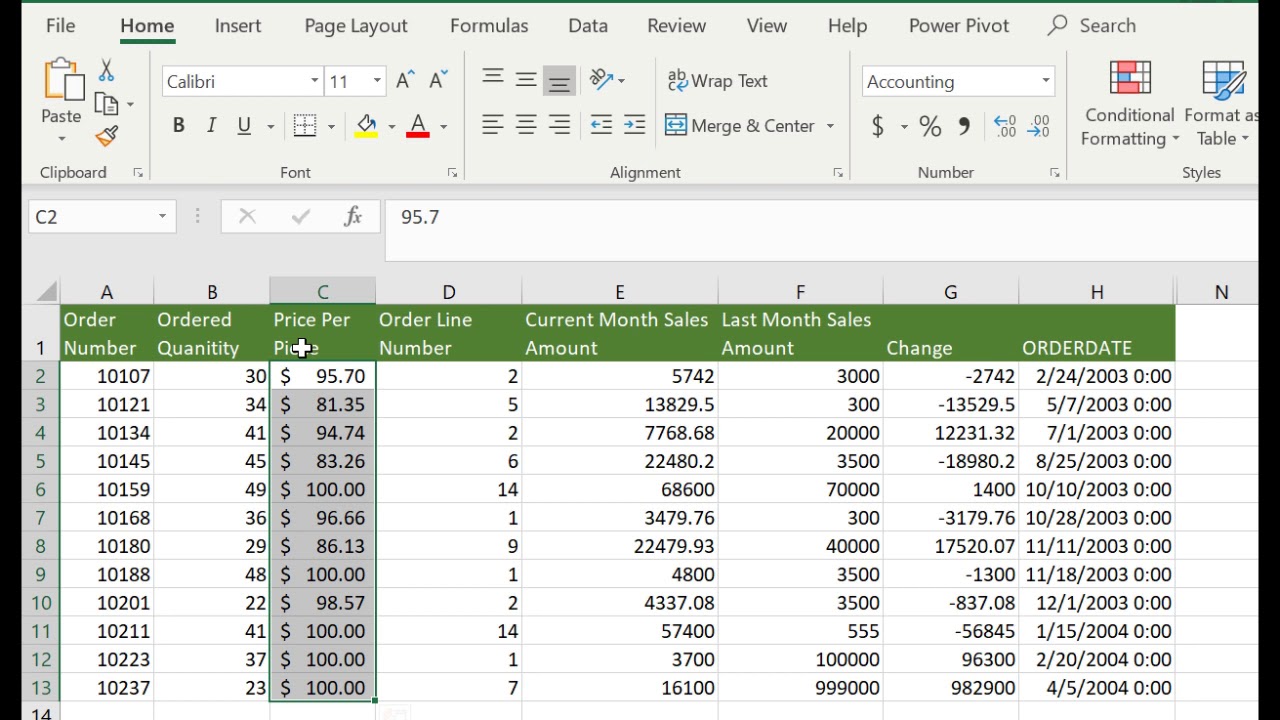

Higher risk home loans set obtainable was basically more profitable having WaMu, by highest rate one to Wall surface Roadway underwriters and you will buyers have been happy to pay for all of them. The brand new earnings you to WaMu received by attempting to sell or securitizing a loan is actually referred to as “obtain available.” Get available for sale rates with the funds created by the bank was indeed examined and you may presented to new WaMu Board out of Directors. For the u Mortgage brokers division, given the Board regarding Administrators a confidential presentation entitled, “Mortgage brokers Conversation.” |168| The 3rd slip on the speech try titled, “Mortgage brokers Proper Position,” and stated: “Mortgage brokers is quickening tall enterprize model alter to get to consistent, continuous financial objectives.” |169| Underneath that it supposed the initial listed goal are: “Shift regarding lowest-margin providers in order to highest-margin things,” |170| meaning out-of reduced winning in order to more profitable mortgage factors. The next slide throughout the demonstration is actually titled: “Shift to better Margin Activities,” and you can elaborated thereon purpose. The fresh slide noted the genuine acquire discounted received from the financial, when you look at the 2005, for every sort of financing WaMu offered, offering the “foundation points” (bps) that each and every kind of mortgage fetched for the Wall structure Roadway:

Mr. Schneider advised the Subcommittee that quantity on the graph were not projections, nevertheless wide variety generated off real, historical mortgage research. |172| Once the chart makes clear, minimum of winning financing having WaMu was basically bodies recognized and repaired speed fund. People funds had been generally ordered because of the government sponsored companies (GSEs) including Federal national mortgage association, Freddie Mac, and you will Ginnie Mae hence reduced relatively low prices in their mind. In lieu of targeting men and women reasonable u’s administration looked to build profits someplace else, and you may opted for to focus on the essential successful funds, which were the option Case, family equity, and you will subprime funds. During the 2005, subprime money, having 150 foundation situations, was seven minutes more profitable than a predetermined rate mortgage within 19 basis affairs and most ten moments given that profitable just like the regulators backed funds.