- Progressive money-dependent cost agreements are manufactured for the 2007 provide consumers affordable monthly obligations.

- However, students-loan company worker exactly who watched this new program’s manufacturing told you it absolutely was crappy from the start.

- She explained an emotional records process and you may mounting appeal that comes with the fresh agreements.

The reason for money-motivated fees arrangements to have college loans is within the term: Give individuals sensible monthly premiums according to research by the money they might be taking home, toward hope out of loan forgiveness shortly after on 20 years.

But a worker from the a small college student-financial institution into the Iowa who was simply indeed there in the event that Education Company created the earnings-built payment system inside the 2007 told Insider it was faulty at the latest outset.

“The implementation of this tactic is actually never the trouble,” said the new worker, which asked to remain unknown however, whoever term is known to Insider. “It absolutely was a bad system throughout the start.”

The latest arrangements allow it to be borrowers having lead government financing otherwise fund by way of the brand new Federal Members of the family Education loan system, being really kept, to spend them down as a consequence of monthly installments fixed at the a share of the discretionary income, having forgiveness immediately after 20 otherwise 25 years from repayment.

As the first money-driven installment bundle – referred to as income-contingent repayment bundle – is actually brought inside 1994, whenever Chairman Joe Biden grabbed work environment a year ago simply 32 individuals full had been given forgiveness, and you will attract to your funds have additional a serious burden. Investigations keeps described significant problems to the agreements, such as for instance a deep failing to monitor money. Even though the fresh Biden management has launched reforms to your system, brand new staff said new plans’ disappointments are not delivering sufficient desire.

Brand new employee might have been operating during the a beneficial nonprofit student loan organization inside the Iowa that qualities cashadvanceamerica.net tribal installment loans for bad credit direct lenders individual and FFEL loans for more than a good ten years. She said President George W. Bush’s Studies Agencies provided terrible information to enterprises towards undertaking brand new arrangements, causing an emotional application procedure that was with mounting focus on money.

“I didn’t also should tell some one on the mortgage forgiveness once the we don’t want anyone banking inside,” the brand new worker told you. “While the we realized just how impractical it would be so they are able have it. People are gonna accrue plenty of desire, and it’s really going to be extremely bad for her or him, therefore most failed to need to offer they on them.”

An NPR investigation to your money-passionate cost arrangements penned inside feedback indicated about three pupil-collectors – Mohela, Cornerstone, additionally the Pennsylvania Degree Guidelines Institution – just weren’t tracking borrowers’ repayments toward the agreements, definition consumers was required to ask the businesses “to-do a work-extreme details feedback” to decide if they qualified for forgiveness.

“It absolutely was only always difficult, such as for example overly thus,” she said, dealing with enrolling in the fresh arrangements. “The truth is, to have as frequently troubles due to the fact people have obtaining it now, it was ways tough in those days. But nevertheless, you will find more and more people that happen to be that have plenty issues applying.”

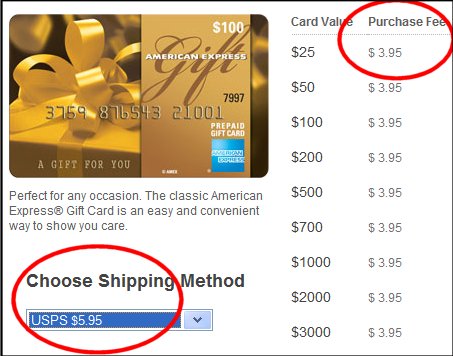

Individuals who wish to subscribe an income-founded fees plan have to render evidence of earnings, which the worker said would be hard, specifically for individuals that happen to be care about-operating. The worker said that when the she cannot ensure the new borrower’s disgusting money and you can frequency from pay, brand new debtor could well be refuted enrollment inside the plans.

She additional that due to the fact app procedure came into existence sometime simplistic and you will compressed on the that setting individuals have to fill out from year to year, it still makes space having error because setting and the support records need significant reliability.

“It isn’t one to tough once you see they day-after-day – if you’re very always it, it’s pretty effortless – but this really is a type people select one time per year, therefore we usually do not expect these to think about they, and it’s also easy to get caught to the,” she told you.

Borrowers on income-created cost plans can face mounting notice

Student-mortgage consumers are most likely completely aware of your own effect of great interest on their personal debt – it’s stopped of numerous off placing a dent throughout the amazing harmony it lent.

A great 59-year-old-man which in the first place lent in the $79,000 advised Insider just last year you to definitely he’d paid down $175,100 nonetheless due $236,485. The guy described it as a good “debtors’ jail,” stating the eye collected had left your inside the an endless course of fees.

Income-driven preparations including include attract. New worker mentioned that placing some body with the a twenty five-seasons payment plan don’t avoid focus from increasing. She said that if the a borrower was later during the recertifying their money, the attention will cash in – meaning it is placed into the first loan balance, therefore upcoming interest grows centered on one to high count – causing high monthly payments.

Biden’s Training Agencies recently expressed they wants to end focus capitalization as much as possible. If you find yourself that’ll help consumers beginning in 2023, whoever has experienced payment for many years could keep competing with high monthly obligations.

Lawmakers and you will advocates is actually driving Biden going subsequent on reforms

During the December, Biden launched reforms to earnings-motivated cost preparations you to definitely incorporated allowing consumers so you can worry about-declaration the revenue – in the place of submit income tax documents – to try to get or recertify the new agreements using July 31. Inside April, new department advised repairs to the agreements and said it would conduct a single-time upgrade of previous money.

not, a studies Department spokesperson advised Insider with the Thursday one to an improved fees bundle are not as part of the next regulatory proposition, and you can after NPR typed the conclusions, lawmakers into each party of one’s aisle urged the training Institution when planning on taking the newest reforms a step after that.

Sen. Patty Murray and you may Agent. Bobby Scott, brand new seats of your Senate’s and you can Residence’s training committees, authored a letter inside the April urging brand new secretary off degree, Miguel Cardona, to determine a separate money-determined installment bundle “one have costs reasonable, prevents bills out-of ballooning over the years, and provides a reliable pathway of continuous installment.”

And additionally in the April, 117 advocacy groups advised Cardona to make a great waiver to own earnings-determined installment agreements that would retroactively allow one fee a debtor made in order to amount on the loan forgiveness, certainly most other proposals.

An education Service representative advised NPR at the time the service was “conscious of historic problems with earlier in the day procedure which had undermined particular recording regarding qualified costs,” including, “The modern problem try unacceptable and we also was purchased handling the individuals situations.”

“I do believe the us government has actually a task these types of somebody, since the we’ve got done so so you can Gen Xers and you will millennials, however we’re delivering a good amount of Gen Z on there,” she told you. “And this refers to all of these individuals who are getting caught up when you look at the this debt while they was told these were deciding to make the wise plus the fiscally responsible choice to take money-established repayment bundle and get a repayment one to coordinated the money. And all of it is over is simply produce substantial personal debt.”