That staff members does rise whenever interest levels is lowest and you can construction directory was numerous, and you can sense sharp occupations cuts when rising rates and you will tight inventory provides discourage to shop for and refinancing.

Experts state Wells Fargo or other federal and you can awesome-local banking institutions have forfeit business to help you online financial institutions, particularly Skyrocket Mortgage, United Coast Monetary and you will Loan Depot.

When calculating of the worth of financing, Wells Fargo are third during the $159 mil, JPMorgan was 5th in the $134 million and you may Lender of The usa Corp. was 7th during the $85 billion.

Bloomberg Reports claimed into the an Aug. 14 post you to definitely Wells Fargo are move straight back of providing money to possess mortgages produced by third-class lenders, also providing Government Housing Administration loans.

However,, Perhaps my part is we’re not interested in are extremely highest regarding the mortgage team for just the fresh new sake to be from the home loan providers.

Not by yourself

The blend out of even more fintech lenders, fasten lending conditions since construction ripple burst regarding 2008-11, and you can a sharp slide-out-of to date this present year when you look at the refinancing craft has actually other financial institutions questioning the character and proportions about field.

The fresh Mortgage Lenders Association’s home loan report, put-out Aug. twenty-two, discover all of the financial originations have dropped forty eight% loans Pollard of step 3.55 mil throughout the second quarter out-of 2021 to a single.85 mil about 2nd one-fourth of 2022.

Truist chief monetary officer Daryl Bible said in the bank’s fulfilling telephone call that have experts one higher rates is actually forcing loan volumes and you may obtain-on-income margins.

Truist chief executive Costs Rogers told analysts you to financial most likely (was) a tiny apartment last half of the year (compared with) the initial half the year.

Tim Wennes, leader of the You.S. division to own Santander, advised CNBC your bank’s choice to depart domestic mortgage credit inside the March try motivated generally by decline in financial quantities. This has place the financing focus on automobile financing, that are providing high productivity.

For the majority, particularly the reduced organizations, all the home loan volume is re-finance activity, that is drying out up-and will likely drive a shakeout, Wennes told you.

Fintech pros and cons

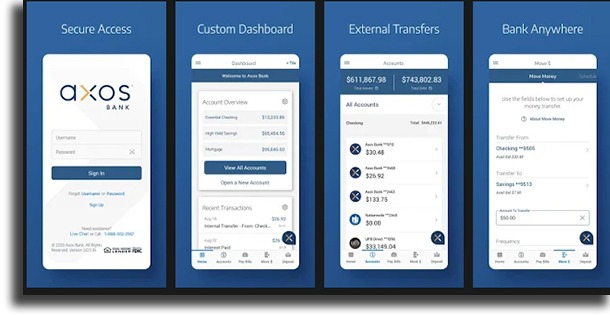

A fast and you will streamlined strategy ‘s the chief aggressive virtue you to definitely fintechs provides over antique financial institutions, borrowing unions or other conventional lenders.

Fintechs features founded the life to your most useful using big investigation, investigation statistics, cutting-edge formulas, and you can fake intelligence – which permit choice lenders to higher evaluate borrower’s creditworthiness and you will visited usually lower than-supported communities, composed Sandra Lankford in an excellent July 22 blogs into browse company Wolters Kluwer.

Somebody and you may businesses fill in its suggestions online otherwise due to a keen application, publish records electronically, and get one-point of experience of the lending company.

Solution loan providers are not the right choice for everyone domestic otherwise industrial consumers. Customers shop for an informed interest rates and you will terms and conditions, that can nevertheless are from banks.

Even if fintech companies are known for scientific advancements and providing qualities such digital mortgages, information security stays a top matter, she said. Likewise, the federal government does not handle low-financial financial institutions just like the securely just like the banking institutions.

This new solutions

Many traditional banking companies and you will credit partnership possess responded to new fintech race by the seeking to accept a few of the same large data statistics.

Eg, Truist might have been increasing on the a digital-first method introduced inside the 2019 by predecessor BB&T Corp. and its president and you may chief executive Kelly Queen.

Initial entitled Interrupt otherwise pass away, the lending company softened the word to Interrupt and you may flourish because it plugged in phony intelligence and you may robotics to the the right back-workplace, customer-services and you may compliance surgery.