Are you thinking out-of home ownership however, concerned with brand new economic difficulties? A beneficial USDA home loan might be the answer you are searching for. This type of money, backed by the usa Service from Farming, offer a unique path to help you homeownership that have attractive positives eg no deposit and versatile credit conditions.

But what may be the requirements having a beneficial USDA Financing? This article will walk you through everything you need to discover so you’re able to meet the requirements in 2024, from money restrictions and you will credit score requirements so you’re able to possessions eligibility and the program process.

Whether you are an initial-go out homebuyer otherwise seeking change your current house, understanding the particulars of USDA Finance helps you and come up with informed choices and you can reach finally online installment loans South Carolina your homeownership wants.

Why Choose good USDA Loan? An instant Glance at the Masters

USDA Funds give yet another mix of experts, leading them to a nice-looking selection for of a lot homeowners, specifically those during the certain, qualified components. Some key experts tend to be:

- Zero Down-payment : Leave behind the burden out of rescuing having a giant off fee.

- Aggressive Interest rates : See potentially straight down rates versus Conventional Finance .

- Flexible Borrowing Standards : Despite incomplete borrowing from the bank, you might still meet the requirements.

- All the way down Financial Insurance rates : USDA Funds features lower ensure charges than just FHA Fund .

Getting a further explore this type of masters (and more), make sure to here are a few all of our full book, The brand new 8 Trick Benefits associated with USDA Finance .

Who may have Eligible? Borrower Conditions to possess a USDA Loan during the 2024

Qualifying having a great USDA Mortgage relates to conference particular conditions put by the united states Agencies out of Agriculture . Let us fall apart all you have to see:

Location: USDA Financial Family Conditions

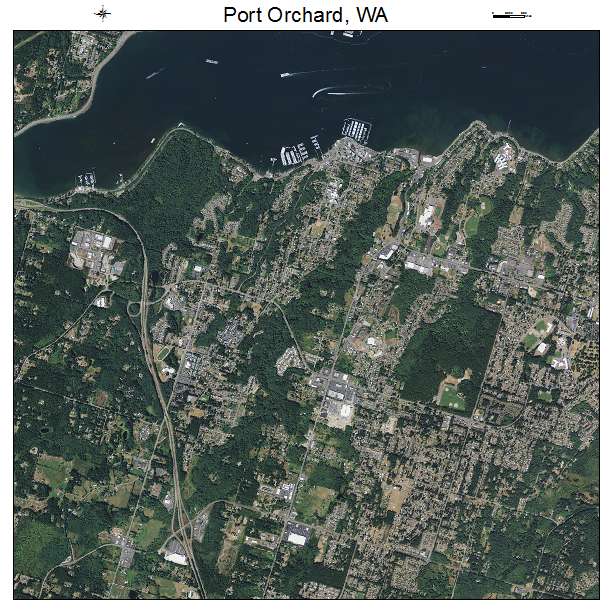

We’ll break down the house or property criteria in detail later, but also for now, it is critical to discover what exactly is suggested because of the rural. The term outlying area might conjure right up photo out-of vast farmland, nevertheless the USDA’s meaning is largely a bit greater. In fact, many suburban section and also certain reduced towns and cities qualify for USDA Fund. The reason being brand new USDA takes into account inhabitants occurrence, not simply location whenever designating eligible components.

To be sure your perfect family qualifies, a knowledgeable approach is to utilize our USDA interactive qualification map. Which member-friendly tool allows you to get into an address or zoom when you look at the towards a specific spot to see if they drops contained in this an effective USDA-appointed rural city. Alternatively, you could consult with financing Administrator who’s familiar with USDA Money. They are able to supply the qualification study and you may establish in case your fantasy possessions matches the spot requirements.

Money Limits: Exactly what are the Standards to have an excellent USDA Financing with regards to Income?

USDA Finance are designed to build homeownership open to reasonable- and you may average-income household residing in particular elements. In order to qualify, the overall household income do not exceed 115% of your own urban area average earnings (AMI). Brand new AMI try a statistical way of measuring the common complete income generated by the all of the group when you look at the a particular local area. With this specific metric, the USDA assurances the mortgage applications is actually focused on the home in need of them very.

You should check the area’s earnings limitations with the interactive USDA earnings qualification tool . Click the condition you find attractive, and you’ll score wisdom toward various other earnings membership getting everything of single-person property to help you household that have 8+ people!

The newest 115% foundation provides particular flexibility, enabling far more family members in order to meet the requirements. Yet not, it is important to remember that the earnings limit for your condition varies according to 2 important aspects:

- Area : Earnings limitations will vary more from the geographic place. Outlying elements that have a higher cost-of-living will naturally provides highest earnings constraints than section which have a lower life expectancy cost-of-living.