You can also must take into account personal home loan insurance (PMI). Home owners would have to spend PMI when they never generate from the least a 20% advance payment on the domestic. Along with such prospective will cost you, it is useful to use the Ohio mortgage calculator. All of our device will help break apart your can cost you so you’re able to see what your own monthly mortgage repayments will appear like in some other circumstances. Should you want to refinance a current mortgage, our very own Ohio mortgage calculator may also help you determine the month-to-month payment — and you may here are some the set of a knowledgeable refinance loan providers to locate one to process become.

Before buying a home inside the Ohio, it is vital to make sure to have your money in check. You will need:

- Good credit

- A low financial obligation-to-income ratio

- A constant income source

- A down payment stored

- More funds beyond the down-payment to fund lingering repair, fixes, or any other issues

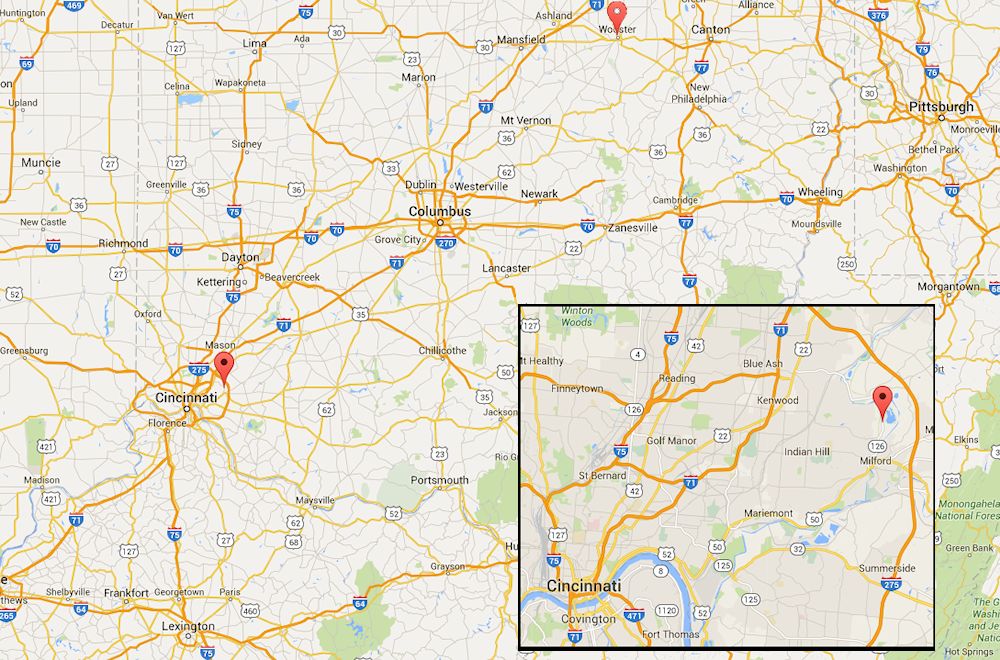

There are also certain specific things you ought to know out-of when selecting property when you look at the Ohio. The state has actually five line of natural countries: the new Lake Flatlands, Till Plains, Unglaciated Appalachian Plateau, Glaciated Appalachian Plateau, and the Lexington Simple. Because of its proximity so you can big rivers being about Midwest, Kansas is at the mercy of ton and you may tornadoes.

Ohio and additionally is sold with four away from Realtor’s ideal twenty five houses : Toledo (Zero. 10), Columbus (Zero. 14), Cincinnati (Zero. 19), and you can Dayton (Zero. 23). These types of locations is rated because of the conversion and you will speed increases.

Strategies for basic-time homebuyers for the Ohio

Check out crucial approaches for first-big date homebuyers to help them browse the process. There are a few programs designed for very first-go out home buyers through the Ohio Housing Loans Department (OHFA). OHFA offers conventional mortgage loans customized particularly for homebuyers having low- and you may reasonable-revenues.

OHFA allows homebuyers to decide sometimes a two.5% otherwise 5% down-payment of home’s cost. Advice can be applied for the off repayments, closing costs, or other pre-closure expenses. Which assistance is forgiven shortly after eight online loans Palmetto, FL age.

To qualify for the fresh new OHFA The choice! Deposit Guidelines program, home buyers will demand at least credit rating regarding 640, see earnings and purchase speed constraints, and you will see obligations-to-income percentages into financing type of.

- FHA financing are mortgages straight back of the Government Housing Authority and you can want an excellent step 3.5% down-payment.

- Va finance is to have army service participants and require a 0% advance payment.

- USDA financing try authorities-supported funds having qualified qualities and want an effective 0% down-payment.

- Federal national mortgage association and you can Freddie Mac is actually conventional fund that need an effective 3% downpayment.

Choose a house-to order budget

After you’ve and also shopped doing with various loan providers, it is very important go for a house-buying finances. Many it is strongly recommended that your particular month-to-month family fee (along with extra will set you back) become only about 31% of month-to-month money.

It can be important to care for good credit, thus usually do not apply for people handmade cards or other loans best in advance of your home search. Credit file concerns will impression your credit score. Its also wise to have enough money conserved getting closing costs. Other charges instance loan charges, checks, and processing costs are maybe not usually included in the borrowed funds.

Still have inquiries?

Residents can be part of a home owners organization (HOA) as well as have to pay a monthly HOA percentage near the top of their home loan repayments. HOA charge usually cover the constant maintenance away from well-known components, and sometimes become services such as for instance scrap pickup. To enter this type of extra costs toward more than financial calculator having Ohio, simply click “More enters” (less than “Home loan particular”).